Utmost Outcome Fund Range

The outcome based approach explained

A commitment to longer-term investment and an increased appetite for measured risk in the approach to retirement and beyond.

A pension plan for most people is the financial asset with the longest time horizon particularly if you intend to maintain the pension fund right through retirement.

In order to build wealth over the long-term, it is imperative that investment returns meet or exceed the rate of inflation1 ideally ensuring that the purchasing power of your capital increases with time.

With this in mind, Utmost Corporate Solutions have launched a new range of investment options called the outcome range of insurance funds, with target outcome returns based on inflation +3% and +4% which aims to provide returns over the medium to longer term and whose objectives are to exceed inflation.

| OUTCOME FUNDS OVERVIEW SHEETS | LAUNCH DATE |

|---|---|

| Utmost Outcome Strategy Fund (Inflation Target +1%) GBP | May 2019 |

| Utmost Outcome Strategy Fund (Inflation Target +1%) EUR | May 2019 |

| Utmost Outcome Strategy Fund (Inflation Target +1%) USD | May 2019 |

| Utmost Outcome Strategy Fund (Inflation Target +3%) GBP | March 2012 |

| Utmost Outcome Strategy Fund (Inflation Target +3%) EUR | October 2015 |

| Utmost Outcome Strategy Fund (Inflation Target +3%) USD | October 2015 |

| Utmost Outcome Strategy Fund (Inflation Target +4%) GBP | November 2018 |

| Utmost Outcome Strategy Fund (Inflation Target +4%) EUR | November 2018 |

| Utmost Outcome Strategy Fund (Inflation Target +4%) USD | November 2018 |

Why targeted outcome?

There are a number of key challenges in the current market environment. Research expects that the world population is likely to spend up to 25% more time in retirement than they did in the workforce2 , meaning that people will need a lot more money to fund living and lifestyles than ever previously required. Lacklustre deposit savings rates and ageing populations coupled with low birth/fertility rates will impact the ability of governments to provide state pensions, and pensionable age is set to further increase as a consequence.

10 years after the Global Financial Crisis, risk and volatility in investment and savings are likely here to stay4,5,6 and we believe at Utmost Worldwide, people need a way to maximise the accumulation of savings to provide for future retirement income and protecting these hard-earned savings is also paramount.

To summarise

The launch of the outcome fund range is the culmination of Utmost Corporate Solutions research into historic investment performance and expectations for future investment returns. When looking forward, especially over the longer term, we focus on the likely economic backdrop coupled with asset valuations and less on sentiment, which frequently dominates shorter-term market performance. Our funds’ strategic asset allocations are constructed using a combination of inputs, the most significant being risk and our long-term investment projections.

From our research, we have constructed funds that utilise different asset classes to produce targeted returns suited to the likely risk appetite of our customers.

We recognise that as time horizons reduce, forecasting is increasingly challenging. We are also cognisant of studies which highlight that investment returns, excluding a small proportion of exceptional days, are significantly lower where market timing resulted in missing some of the strongest stock market returns.

Our message therefore is clear, save now and stay invested, it’s “time in the market”, as opposed to “timing the market” that is important. For example, the performance of a $10,000 investment between 1st January 1997 and 30th December 2016 shows a fully invested return of 7.68%, this falls to a 1.57% return for those who missed the 20 best days3

Sources:

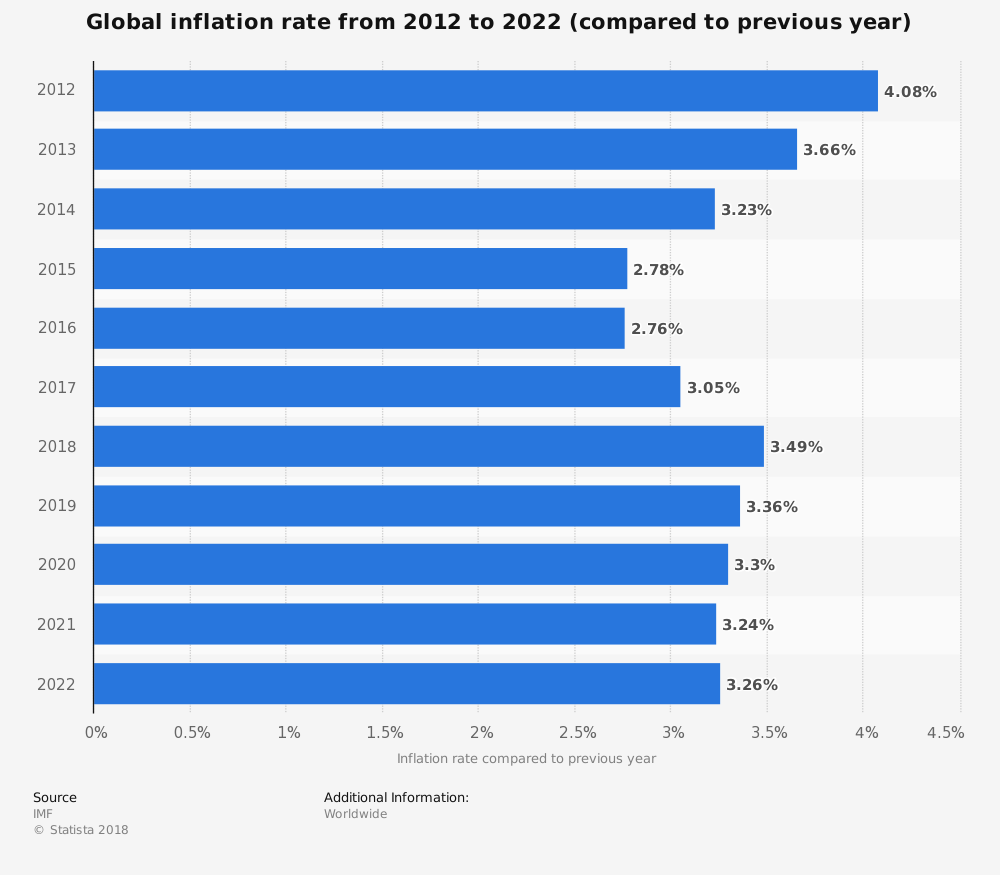

1Source: Global Inflation rate from 2012 to 2022 (compared to the previous year). This statistic shows the global inflation rate compared to previous year from 2012 to 2022. In 2017, the inflation rate worldwide amounted to approximately 3.05 % compared to the previous year.

Article edited with the free HTML composer tool. Use this web content editor to make sure your markup is error-free.

2Source: Human Mortality Database, University of California, Berkeley (USA) and Max Planck Institute for Demographic Research (Germany). Percentages based on Japan, which has the world’s most rapidly aging population, retirement currently begins at 60 years, their life expectancy is 107 (oldest age at which 50% of babies born in 2007 are predicted to still be alive). Effectively, this could result in a retirement of over 45 years for those who live to the current life expectancy of 107.

3Source: JP Morgan Asset Management. Returns based on the S&P 500 Total Return Index. Data as at December 31st 2016 .

You should note that investment involves risk. Past performance is not indicative of future performance. Investors and/or their investment advisers are responsible for their investment decisions and any choice of investment options is entirely at their own risk. Please note that investment performance (as well as the income accruing to an investment) may go down as well as up. Our outcome range is constructed as insurance funds of Utmost Worldwide Limited and are not separate legal entities or separately regulated. Our outcome funds are available only as an investment option linked to our insurance and savings products, and no third party direct investment can be accepted.

4 https://www.ft.com/content/96c67306-0f3a-11e8-8cb6-b9ccc4c4dbbb

5 https://seekingalpha.com/article/4145821-axel-merk-volatility-stay