This briefing is designed for financial advisers only and should not be distributed to or relied upon by individual investors.

This briefing is designed for financial advisers only and should not be distributed to or relied upon by individual investors.

Welcome to the Winter 2026 edition of NAVIGATOR.

This edition arrives as cross border tax rules continue to shift, with advisers facing greater scrutiny, tighter regimes and increasingly mobile clients. As ever, NAVIGATOR provides the insight and practical guidance needed to stay ahead.

Our Technical Spotlight examines HNW Expat Tax Regimes. It opens with Brendan Harper’s overview, outlining both the opportunities and the pitfalls advisers must understand as they plan within these regimes. This is followed by five market specific articles covering the expat tax regimes of the UK, France, Portugal, Spain and Italy, and concludes with the key insight that portability, through an insurance-based wealth solution, can outperform individual expat regimes over the long term.

This edition highlights key developments across Regulation, Tax and Compliance, including Colombia’s revised Wealth Tax for 2026, Belgium’s Budget measures and France’s changing social contribution landscape.

Elsewhere, Navigator Voices features my exclusive interview with Paul Thompson, CEO of Utmost. Marking ten years since the Utmost brand launch, Paul shares what defines a resilient life company and highlights three trends set to shape the industry in 2026 and beyond.

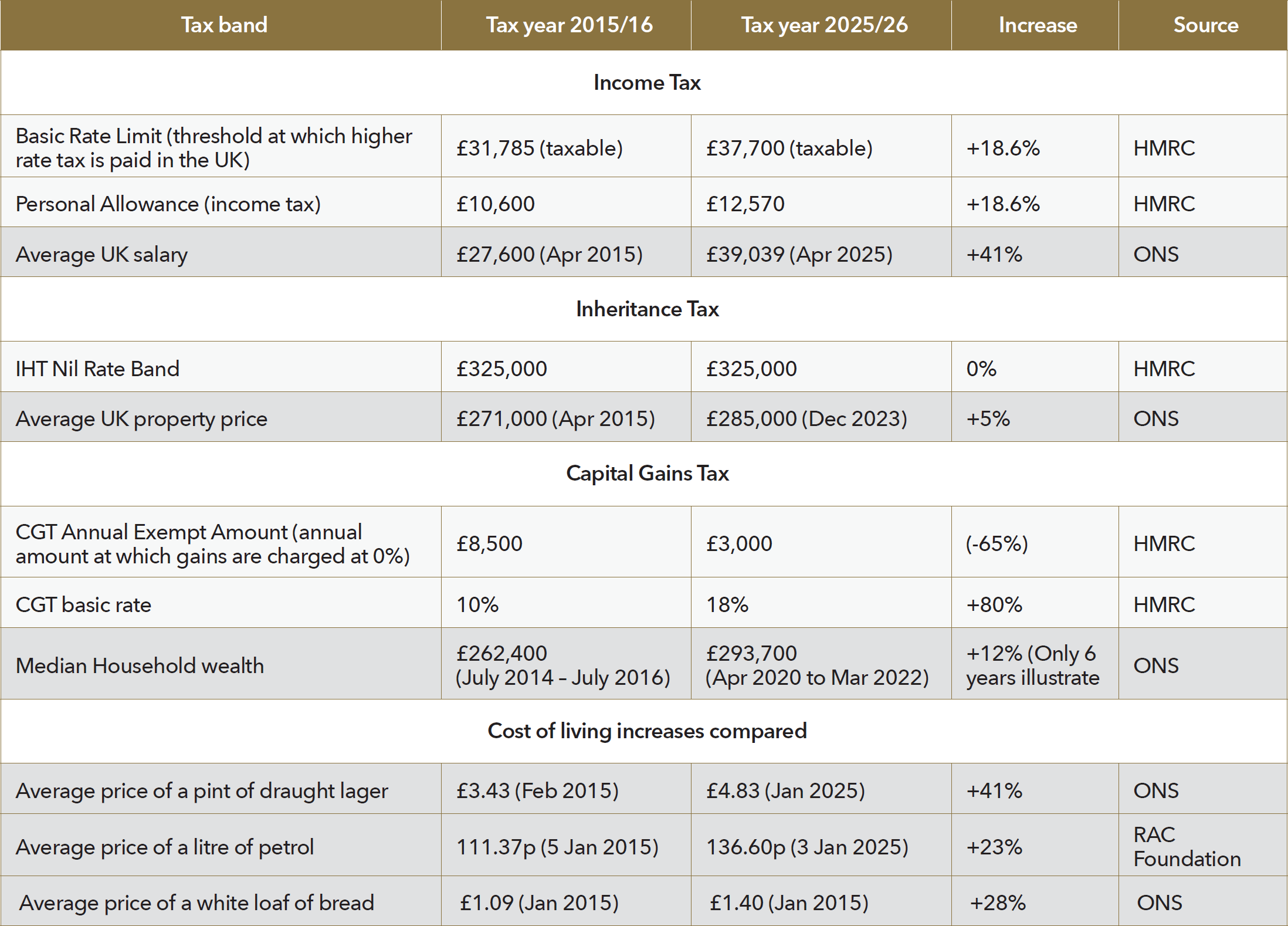

In Country Focus, we look at the growing impact of fiscal drag on UK clients. We also include a case study that shows how an insurance-based solution can mitigate fiscal drag for UK clients.

As always, our aim is to equip advisers with clear, practical analysis that supports thoughtful, compliant and forward looking planning for clients.

Thank you for reading, and for your continued engagement with NAVIGATOR.

Aidan Golden

Head of Group Technical Services

Bienvenue dans l’édition Hiver 2026 de NAVIGATOR.

Cette édition paraît dans un contexte où les règles fiscales transfrontalières continuent d’évoluer, les conseillers étant soumis à une surveillance accrue, à des régimes plus stricts et à une clientèle de plus en plus mobile. Comme toujours, NAVIGATOR fournit l’analyse et les orientations pratiques nécessaires pour garder une longueur d’avance.

Notre Technical Spotlight est consacré aux régimes fiscaux applicables aux expatriés à haut niveau de patrimoine (HNW). Il s’ouvre par une analyse de Brendan Harper, qui présente à la fois les opportunités et les risques que les conseillers doivent comprendre lorsqu’ils planifient dans le cadre de ces régimes. Cette section est suivie de cinq articles spécifiques par marché, couvrant les régimes fiscaux des expatriés au Royaume-Uni, en France, au Portugal, en Espagne et en Italie, et se conclut par un constat clé : la portabilité, via une solution patrimoniale adossée à l’assurance-vie, peut s’avérer plus performante à long terme que les régimes d’expatriation pris individuellement.

Cette édition met également en lumière les principales évolutions en matière de Réglementation, Fiscalité et Conformité, notamment la révision de l’impôt sur la fortune en Colombie pour 2026, les mesures budgétaires en Belgique et l’évolution du cadre des contributions sociales en France.

Dans Navigator Voices, vous retrouverez mon entretien exclusif avec Paul Thompson, CEO d’Utmost. Marquant les dix ans du lancement de la marque Utmost, Paul explique ce qui définit une compagnie d’assurance-vie résiliente et met en avant trois tendances appelées à façonner le secteur en 2026 et au-delà.

Dans Country Focus, nous analysons l’impact croissant du fiscal drag (érosion fiscale progressive) sur les clients britanniques. Nous présentons également une étude de cas illustrant comment une solution patrimoniale adossée à l’assurance-vie peut contribuer à en atténuer les effets pour ces clients.

Comme toujours, notre objectif est de fournir aux conseillers une analyse claire et opérationnelle, afin de soutenir une planification réfléchie, conforme et tournée vers l’avenir.

Merci de votre lecture et de votre engagement continu envers NAVIGATOR.

Aidan Golden

Head of Group Technical Services

On 23 November 2025, the Belgian government agreed its Budget for 2026. Two measures are particularly relevant for the commercialisation of life insurance contracts for Belgian resident policyholders:

The draft law introducing the new capital gains tax was submitted to the Belgian Parliament at the end of December. Although it still requires parliamentary debate and a formal vote, the law is expected to apply retroactively from 1 January 2026. Belgian residents should therefore assume the tax is already in effect, even though some details may change before final approval.

The main principles remain consistent with those outlined in our Summer 2025 Navigator article. The tax will apply at 10% on capital gains realised from 1 January 2026 on all financial products, including withdrawals or surrenders from life insurance contracts. An exit tax will also apply for two years after leaving Belgium.

Why Life Insurance Matters

Unit-linked life insurance contracts may become more attractive under this regime because they offer tax deferral benefits. Unlike other financial products, these contracts allow capital losses and gains on underlying assets to be offset without time limits. Switching investment funds within a Branch 23 policy will not trigger a taxable gain, and the policy structure simplifies administration compared to a directly held investment portfolio.

Points of Attention

The ATSA applies to securities accounts above €1,000,000 held by Belgian residents. The rate has doubled from 0.15% to 0.30%. However, ATSA does not apply to insurance contracts where the underlying securities account is held by a Luxembourg insurer (potentially also including its Belgian Branch, depending on the set-up of the branch) and the custodian bank is outside Belgium. In such cases, the Luxembourg insurer is the legal owner of the account, and the Belgium–Luxembourg tax treaty prevents Belgium from taxing these assets.

The Belgian Budget for 2026 introduces meaningful changes that will influence how advisers support clients with Belgian tax exposure. The new capital gains tax and the higher ATSA rate reinforce the value of life insurance-based wealth solutions, particularly where clients seek tax deferral, administrative simplicity and planning flexibility. As the legislative process progresses, advisers should continue to monitor developments and ensure policyholders receive timely guidance based on the final law.

If you wish to review the draft law, it is accessible here on La Chambre.be

De Belgische begroting voor 2026 introduceert twee belangrijke fiscale wijzigingen die van invloed zullen zijn op de manier waarop adviseurs hun cliënten, Belgische residenten ondersteunen met betrekking tot vermogensplanning. De bevestiging van een nieuwe meerwaardebelasting, gecombineerd met een verhoging van de jaarlijkse taks op effectenrekeningen (JTER), betekent een opmerkelijke verschuiving in het fiscale landschap van het land.

Nicolaas Vancrombrugge schetst wat deze maatregelen in de praktijk betekenen en belicht de kansen die op levensverzekeringen gebaseerde vermogensoplossingen kunnen bieden in een veranderende regelgevende omgeving.

Op 23 november 2025 keurde de Belgische regering haar begroting voor 2026 goed. Twee maatregelen zijn bijzonder relevant voor de commercialisering van levensverzekeringscontracten voor Belgische verzekeringnemers:

Het wetsontwerp tot invoering van de nieuwe meerwaardebelasting werd eind december ingediend bij het Belgische parlement. Hoewel het nog moet worden besproken in het parlement en formeel dient te worden goedgekeurd, zal de wet naar verwachting met terugwerkende kracht van toepassing zijn vanaf 1 januari 2026. Belgische ingezetenen moeten er dus vanuit gaan dat de belasting al van kracht is, ook al kunnen sommige details nog wijzigen voordat de wet definitief wordt goedgekeurd.

De belangrijkste principes blijven in overeenstemming met die welke in ons artikel in de Navigator van zomer 2025 reeds werden uiteengezet. De belasting zal 10% bedragen op vermogenswinst die vanaf 1 januari 2026 wordt gerealiseerd op alle financiële producten, met inbegrip van opnames of afkopen uit levensverzekeringsovereenkomsten. Er zal ook een exit taks van toepassing zijn gedurende twee jaar na het verlaten van België.

Waarom levensverzekeringen belangrijk zijn

Levensverzekeringscontracten die aan beleggingsfondsen zijn gekoppeld, kunnen onder dit stelsel aantrekkelijker worden omdat ze voordelen op het gebied van belastinguitstel bieden. In tegenstelling tot andere financiële producten kunnen bij deze contracten kapitaalverliezen en -winsten op onderliggende activa zonder tijdslimiet worden gecompenseerd. Het wisselen van beleggingsfondsen binnen een tak 23-polis leidt niet tot een belastbare winst, en de structuur van de polis vereenvoudigt de administratie in vergelijking met een rechtstreeks aangehouden investeringsportefeuille.

Aandachtspunten

De JTER is van toepassing op effectenrekeningen van meer dan € 1.000.000 die worden aangehouden door Belgische ingezetenen. Het tarief is verdubbeld van 0,15% naar 0,30%. De JTER is echter niet van toepassing op verzekeringscontracten waarbij de onderliggende effectenrekening wordt aangehouden door een Luxemburgse verzekeraar (eventueel ook inclusief zijn Belgische bijkantoor, afhankelijk van de opzet van het bijkantoor) en de bewaarnemingsbank zich buiten België bevindt. In dergelijke gevallen is de Luxemburgse verzekeraar de wettelijke eigenaar van de rekening en verhindert het belastingverdrag tussen België en Luxemburg dat België deze activa belast.

De Belgische begroting voor 2026 introduceert belangrijke wijzigingen die van invloed zullen zijn op de manier waarop adviseurs klanten die Belgische ingezetenen zijn, ondersteunen. De nieuwe meerwaardebelasting en het hogere JTER-tarief versterken de waarde van op levensverzekeringen gebaseerde vermogensoplossingen, met name wanneer klanten op zoek zijn naar belastinguitstel, administratieve eenvoud en flexibiliteit bij de planning. Naarmate het wetgevingsproces vordert, moeten adviseurs de ontwikkelingen blijven volgen en ervoor zorgen dat verzekeringnemers tijdig advies krijgen op basis van de definitieve wetgeving.

Als u het wetsontwerp wilt bekijken, kunt u dat hier doen op La Chambre.be

Le budget 2026 de la Belgique introduit deux changements fiscaux importants qui auront une incidence sur la manière dont les conseillers accompagnent leurs clients résidents belges quant à la planification de leur patrimoine. La confirmation d'une nouvelle taxe sur les plus-values, combinée à une augmentation de la taxe annuelle sur les comptes-titres, marque un changement notable dans le paysage fiscal du pays.

Nicolaas Vancrombrugge explique ce que ces mesures signifient dans la pratique et met en évidence les opportunités que peuvent offrir les solutions patrimoniales basées sur l'assurance vie dans un environnement réglementaire en mutation.

Le 23 novembre 2025, le gouvernement belge a approuvé son budget pour 2026. Deux mesures sont particulièrement pertinentes pour la commercialisation des contrats d'assurance-vie destinés aux preneurs d’assurance résidant en Belgique :

Le projet de loi introduisant la nouvelle taxe sur les plus-values a été introduit au Parlement belge à la fin du mois de décembre. Bien qu'il doive encore faire l'objet d'un débat parlementaire et d'un vote formel, la loi devrait s'appliquer rétroactivement à compter du 1er janvier 2026. Les résidents belges doivent donc partir du principe que la taxe est déjà en vigueur, même si certains détails peuvent encore changer avant l'adoption définitive.

Les principes fondamentaux restent conformes à ceux exposés dans notre article Navigator de l'été 2025. La taxe s'appliquera à hauteur de 10 % sur les plus-values réalisées à partir du 1er janvier 2026 sur tous les produits financiers, y compris les retraits ou les rachats de contrats d'assurance-vie. Une taxe de sortie s'appliquera également pendant deux ans après avoir quitté le territoire belge.

Pourquoi l'assurance-vie est-elle importante ?

Les contrats d'assurance-vie liés à des unités de compte pourraient devenir plus attractifs dans le cadre de ce régime, car ils offrent des avantages en matière de report d'impôt. Contrairement à d'autres produits financiers, ces contrats permettent de compenser les pertes et les gains en capital sur les actifs sous-jacents sans limite de temps. Le changement de fonds d'investissement au sein d'une police de la branche 23 ne donnera pas lieu à un gain imposable, et la structure de la police simplifie l'administration par rapport à un portefeuille d’investissement détenu directement.

Points à prendre en considération

La TACT s'applique aux comptes-titres supérieurs à 1 000 000 € détenus par des résidents belges. Le taux a doublé, passant de 0,15 % à 0,30 %. Toutefois, la TACT ne s'applique pas aux contrats d'assurance dont le compte-titres sous-jacent est détenu par un assureur luxembourgeois (y compris, le cas échéant, sa succursale belge, dépendant de la structure de celle-ci) et dont la banque dépositaire est située en dehors de la Belgique. Dans ce cas, l'assureur luxembourgeois est le propriétaire légal du compte, et la convention fiscale entre la Belgique et le Luxembourg empêche la Belgique de taxer ces actifs.

Le budget belge pour 2026 introduit des changements importants qui auront une incidence sur la manière dont les conseillers accompagnent leurs clients résidents belges. La nouvelle taxe sur les plus-values et le taux plus élevé de la TACT renforcent la valeur des solutions patrimoniales basées sur l'assurance vie, en particulier lorsque les clients recherchent un report d'impôt, une simplicité administrative et une flexibilité de planification. À mesure que le processus législatif progresse, les conseillers doivent continuer à suivre l'évolution de la situation et veiller à ce que les preneurs d’assurance reçoivent en temps utile des conseils basés sur la loi définitive.

Si vous souhaitez consulter le projet de loi, il est accessible ici sur La Chambre.be

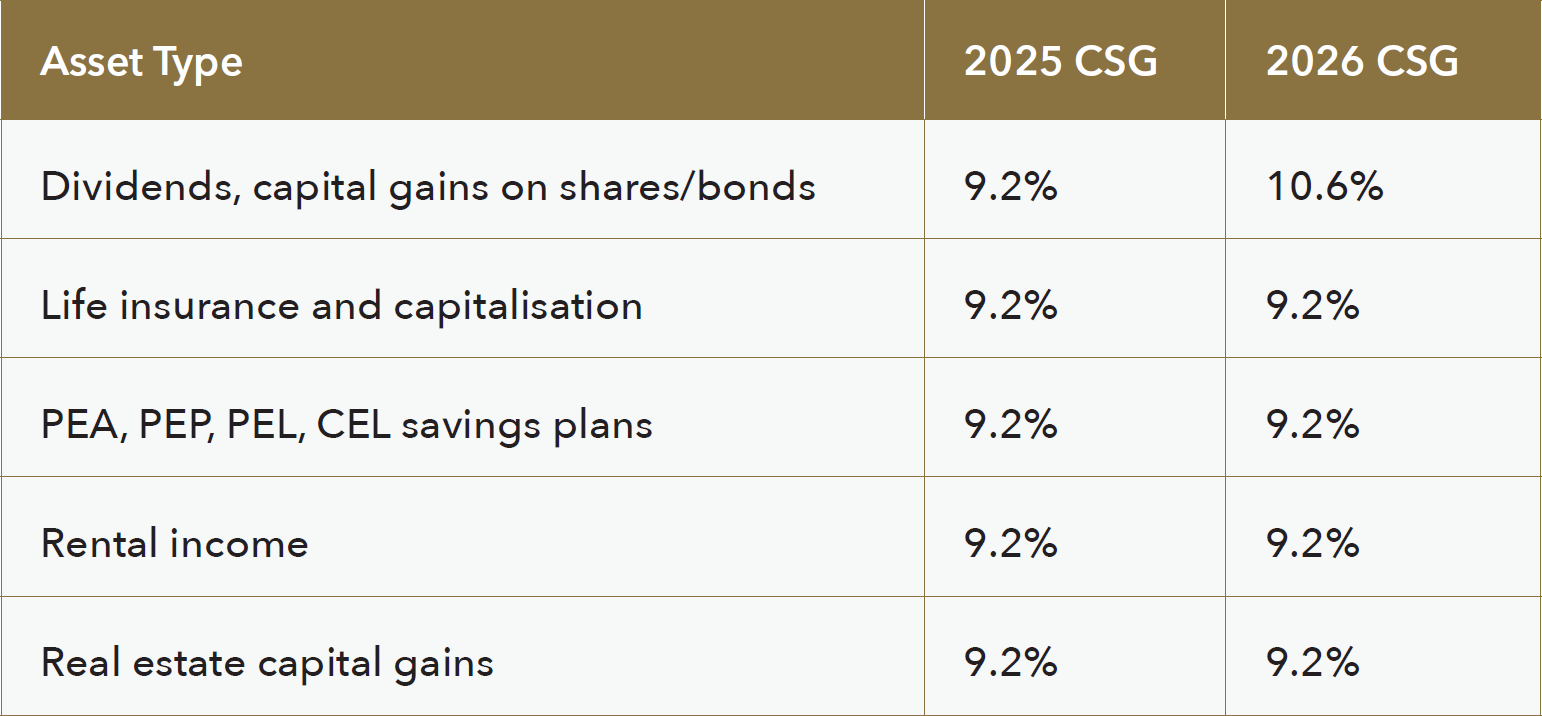

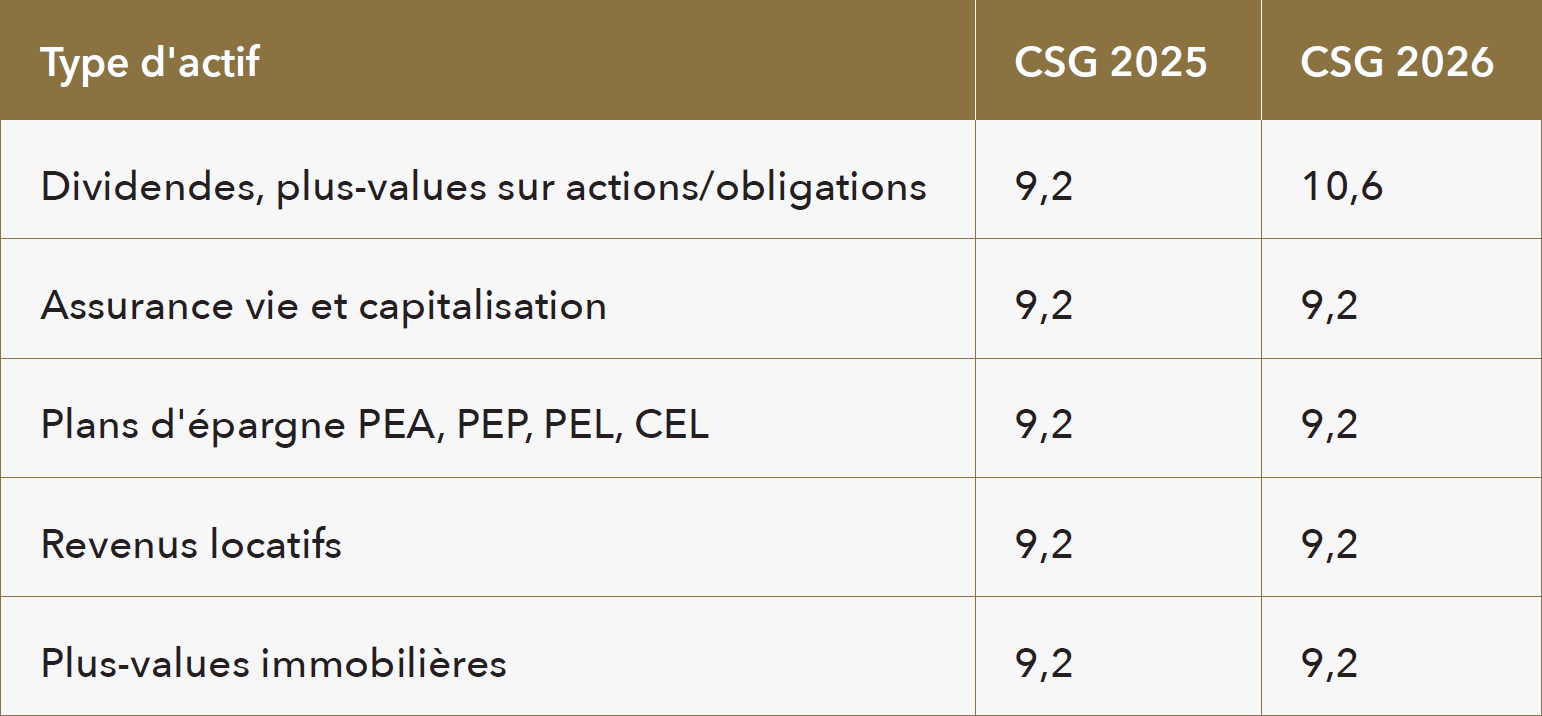

Political constraints prevented Parliament from finalising the Finance Law by year-end, but the law on financing social contributions for 2026 was passed. A government-led compromise distinguishes “financial income” from “popular savings”.

Because the Contribution pour le Remboursement de la Dette Sociale (CRDS) (0.5%) and solidarity levy (7.5%) are unchanged, overall social levies now diverge:

Comparative Table of Rates (CSG component)

Overall Social Levies

Expatriates affiliated to a foreign social security system and holding a valid S1 form are generally exempt from CSG and CRDS on investment income. As a result, the increase to 10.6% CSG does not affect them. However, expatriates remain subject to the 7.5% solidarity levy on applicable income.

Following the UK’s withdrawal from the EU (agreements of 12 November 2019 and 30 December 2020), UK expatriates can continue to benefit from the CSG/CRDS exemption from 1 January 2021, provided they are:

Bottom line: The CSG hike principally impacts domestic investors and expatriates without S1 coverage.

The shift widens the differential between direct portfolios and “popular savings”. For clients comparing portfolio investing with insurance or capitalisation contracts, this change reinforces the relative attractiveness of long-term, policy-based solutions:

Dans le cadre des mesures législatives de fin d'année, la France a introduit des modifications pour les prélèvements sociaux. Dans cet article, Nicolas Morhun et Alix Devalmont expliquent comment la Loi de Financement de la Sécurité Sociale pour 2026 augmente la CSG sur les revenus financiers purs tout en préservant le traitement préférentiel accordé à l'« épargne populaire ».

Pour les conseillers, le message est clair : les portefeuilles titres sont soumis à des prélèvements plus élevés, tandis que les contrats d'assurance vie et de capitalisation bénéficient d’un taux plus faible. Les expatriés affiliés à un régime de sécurité sociale étranger et titulaire d’un formulaire S1 sont largement protégés par cette modification.

Les contraintes politiques ont empêché le Parlement de finaliser la loi de finances avant la fin de l'année, mais la loi relative au Financement de la Sécurité Sociale pour 2026 a été adoptée. Un compromis mené par le gouvernement distingue les « revenus financiers » de l'« épargne populaire ».

La CRDS (0,5 %) et la contribution de solidarité (7,5 %) restant inchangées, les prélèvements sociaux globaux sont désormais pour :

Tableau comparatif des taux (composante CSG)

Prélèvements sociaux globaux

Les expatriés affiliés à un régime de sécurité sociale étranger et titulaires d'un formulaire S1 valide sont généralement exonérés de la CSG et de la CRDS sur les revenus d'investissement. Par conséquent, l'augmentation de la CSG à 10,6 % ne les concerne pas. Toutefois, les expatriés restent soumis à l'impôt de solidarité de 7,5 % sur les revenus concernés.

Suite au retrait du Royaume-Uni de l'UE (accords du 12 novembre 2019 et du 30 décembre 2020), les expatriés britanniques peuvent continuer à bénéficier de l'exonération de la CSG/CRDS à partir du 1er janvier 2021, à condition qu'ils soient :

Conclusion : la hausse de la CSG touche principalement les résidents français et les expatriés en France qui ne sont pas affiliés à un régime de sécurité sociale étranger et qui ne sont pas titulaires d'un formulaire S1.

Ce changement met en avant des différences de taxation entre les portefeuilles titres et l' « épargne populaire ». Pour les clients qui comparent l'investissement en portefeuille titres avec les contrats d'assurance vie et/ou de capitalisation, cette modification renforce l'intérêt des solutions assurantielles à long terme basées sur des contrats d’assurance vie et/ou de capitalisation :

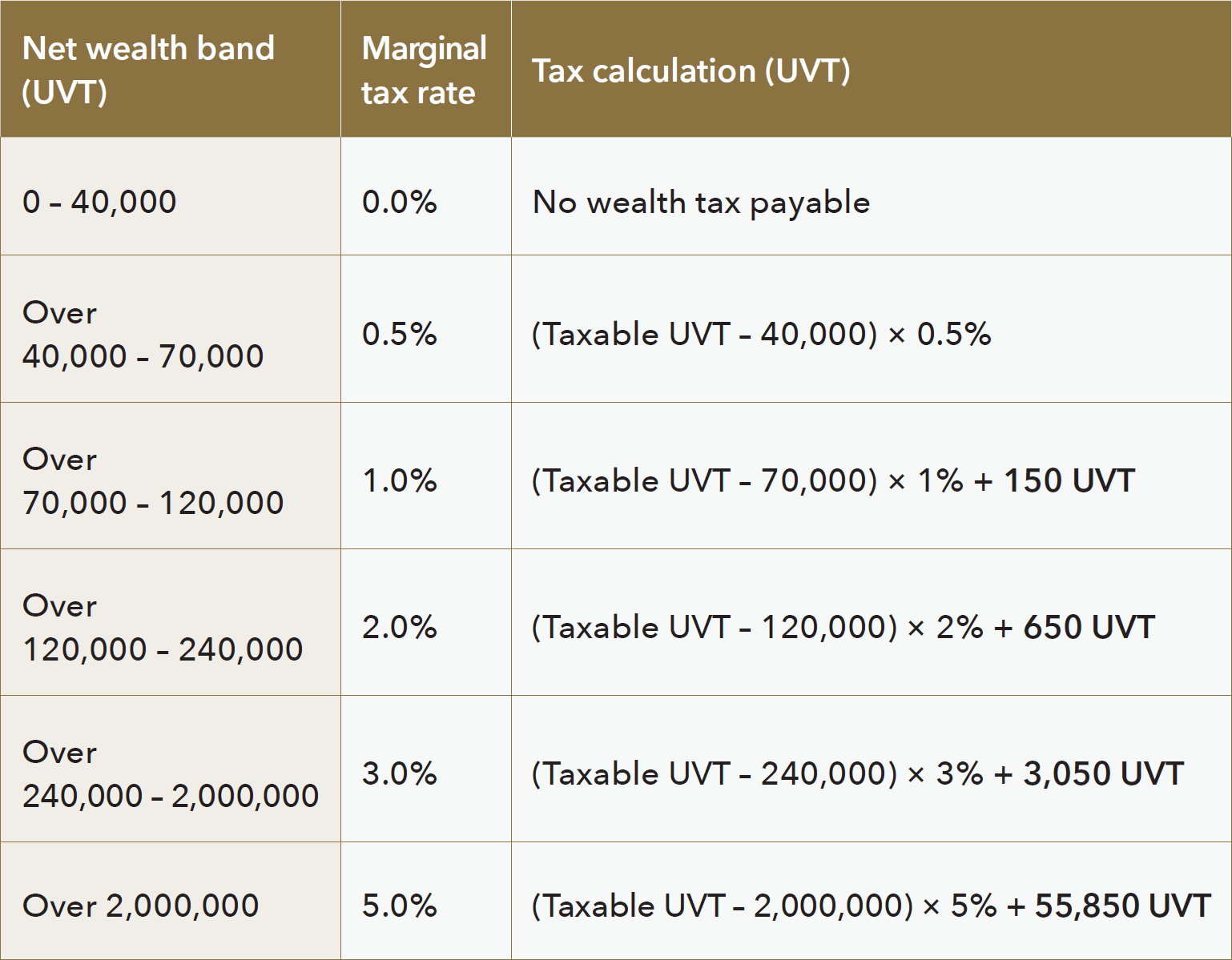

Colombia’s tax conversation took an unexpected turn at the end of 2025. Congress rejected the broader Financing Law on 9 December 2025, which had proposed a significant tax reform. Shortly after, the Government approved Emergency Decree No. 1474-2025 on 29 December 2025 (the “Decree”), temporarily reshaping Colombian Wealth Tax for the 2026 tax year.

The Decree lowers the Wealth Tax entry threshold to 40,000 UVT (approx. USD 530,000), down from 72,000 UVT (approx. USD 960,000). More individuals will now fall within the scope of the tax, as net liquid assets on 1 January 2026 are measured against a much lower bar.

The rate structure is also more progressive. Marginal bands of 0.5%, 1%, 2% and 3% now culminate in a top rate of 5% on net wealth above 2,000,000 UVT (approx. USD 26,500,000). This is a significant increase from the previous maximum rate of 1.5%, which was applied to assets above approx. USD 10,000,000.

The Decree confirms that Wealth Tax applies only to individuals, not to corporate entities. It applies on a temporary basis for the 2026 tax year.

* UVT – Unidad de Valor Tributario.

Colombian tax residents are subject to Wealth Tax on their worldwide assets, including life insurance policies. However, how a policy is valued depends on whether it qualifies as a life insurance contract for tax purposes.

How Life Insurance Policies Are Treated

Unit-Linked Life Insurance Policies (PPLIs)

Unit-linked life insurance policies (also known as “PPLIs”) are not excluded assets for Colombian Wealth Tax. They fall within the Wealth Tax base and must be reported annually. The correct valuation method depends on whether the policy meets the Colombian criteria to qualify as life insurance:

This distinction is critical for advisers and should be confirmed at the start of each Wealth Tax cycle.

Note: USD conversions will vary once the 2026 UVT is finalised.

The 2026 Emergency Decree significantly widens Wealth Tax exposure, and many clients will now fall within scope for the first time. While life insurance policies must be declared for Wealth Tax purposes, their structure is key: when appropriately designed, they can provide smoother and more predictable tax outcomes than the often-volatile valuations of directly held assets. As a result, insurance-based solutions continue to play a central role in long-term planning for high-net-worth individuals resident in Colombia.

The Swedish National Debt Office has confirmed the Government borrowing rate at 2.55% as of 30 November 2025. This sets the effective yield-tax rate for income year 2026 at 1.065%. The increase from the 0.888% rate applied in 2025 reflects interest rates stabilising at a higher level during 2025 compared with 2024.

The Swedish yield tax continues to offer an attractive route for long term investment planning. Life insurance policies allow clients to access international investment opportunities within a simple and predictable tax framework.

Insurance based wealth solutions also offer succession advantages, portability when clients relocate, and efficient administration for both clients and advisers. The ability to hold private equity, pre-IPO shares and a broad range of quoted and unquoted investments make international life insurance an effective diversification tool for Swedish investors seeking wider access to global private banking expertise.

Additional Note on the Tax-Free Allowance

From 1 January 2026, the tax-free amount for life insurance policies and ISK accounts will increase from SEK 150,000 to SEK 300,000. While this uplift has limited impact for higher-value portfolios, it remains a useful enhancement within the overall yield-tax framework, particularly for clients holding smaller balances in these structures.

The lead-up to the 2025 Budget was unusually turbulent, marked by the premature release of the OBR report before the Chancellor had begun her statement. As a result, Budget Day delivered few surprises, with many measures already well trailed.

Advisers can access our full analysis through the following published resources:

These resources provide a practical reference for adviser discussions throughout 2026.

This Spotlight explores major High-Net-Worth tax regimes across core Utmost markets and builds toward the central insight: portability, when structured through an insurance-based solution, can outperform individual expat regimes over the long term. Reviewing all articles provides essential context.

Expat tax regimes are becoming more common as high-tax jurisdictions compete to attract internationally mobile talent. These regimes offer temporary benefits, yet many clients do not appreciate their limits, complexity or the long-term consequences of relying on them. Advisers must understand both the opportunities and the pitfalls.

Brendan Harper examines the key risks associated with expat tax regimes and explains how advisers can support clients navigating these rules.

For globally mobile clients, wealth planning becomes more complicated each time they move. Structures that worked well in one country may not fit local definitions in another. Even simple products, such as pensions or mutual funds, may fail to qualify for favourable treatment. More complex arrangements can trigger anti-roll up rules, leading to punitive tax charges, denial of reliefs and higher reporting obligations.

Brendan Harper explains why portability is essential for clients who move across borders and why advisers need solutions that remain compliant and effective in every jurisdiction.

Expat tax regimes are becoming more common as high-tax jurisdictions compete to attract internationally mobile talent. These regimes offer temporary benefits, yet many clients do not appreciate their limits, complexity or the long-term consequences of relying on them.

Why Governments Introduce These Regimes

Many high-tax countries use special “expatriate” or “flat tax” regimes to attract skilled workers or high-value professionals. In this Technical Spotlight, we explore the key regimes across Utmost’s core markets:

These regimes can be compelling. However, they are also restrictive, temporary and, in some cases, poorly understood. Clients may enter them with unrealistic expectations or without a long-term plan.

1. Strict Qualifying Criteria

Many high-net-worth individuals consider relocating on retirement to live off savings, pensions and investment income. This profile does not meet the stringent employment-based conditions in France, Portugal or Spain.

Portugal’s NIR, for example, applies only to individuals with specific skills in narrow sectors. It also excludes foreign pension income from tax exemption, which can instead be taxed at rates up to 53%. France has equally complex employment-linked requirements.

The UK FIG regime is the least restrictive but still involves comprehensive reporting of worldwide income and gains. For clients with complex international structures, this can create administrative and compliance challenges.

2. Limited Time Frames

These regimes are temporary. Relief can last:

Once the period ends, clients become taxable on worldwide income and gains at full marginal rates. They may also fall within inheritance or wealth tax rules on global assets. If a client intends to remain in the country long-term, these regimes may only offer short-lived relief.

3. Onshore Income and Gains Are Not Covered

Most regimes apply only to offshore income and gains. Spain, France and Portugal provide relief for some employment income, but investment income and onshore gains often fall outside the preferential rules.

Clients who generate substantial local income or who dispose of domestic assets may find the regime offers limited practical value.

4. Cross-Border Connections Still Matter

Many high-net-worth individuals retain ties to other jurisdictions. They may hold assets abroad, have beneficiaries living overseas or plan to move again later in life. Expat regimes grant temporary relief but do not remove the need for long-term, cross-border planning. Planning is still required for local income tax, capital gains tax, inheritance tax and succession rules in other countries to which they are connected.

Special tax regimes can be appealing, but they are not a complete solution. Their strict criteria, temporary nature and limited scope mean advisers must help clients plan beyond the regime. The most robust strategies remain those that local residents would use, rather than relying solely on incentives designed for newcomers.

Insurance-based wealth solutions play an important role here. They help clients secure portability, manage tax exposure across borders and maintain long-term planning continuity even after preferential regimes expire.

Les régimes fiscaux applicables aux expatriés se développent à mesure que les juridictions à forte pression fiscale cherchent à attirer des talents internationaux mobiles. S’ils offrent des avantages temporaires attractifs, de nombreux clients sous-estiment toutefois leurs complexités, leurs restrictions et les conséquences à long terme d’une dépendance excessive à ces dispositifs. Les conseillers doivent comprendre à la fois les opportunités et les risques qui y sont associés.

Brendan Harper analyse les principaux risques liés aux régimes fiscaux des expatriés et explique comment les conseillers peuvent accompagner leurs clients en composant avec ces règles.

Pourquoi les gouvernements mettent en place ces regimes

De nombreux pays à forte fiscalité proposent des régimes spécifiques dits « expatriés » ou des régimes de « prélèvement forfaitaire unique » (flat tax), afin d’attirer des travailleurs qualifiés ou des professionnels à forte valeur ajoutée. Dans ce Focus Technique, nous examinons les principaux régimes en vigueur sur les marchés clés d’Utmost :

Ces dispositifs peuvent se révéler attractifs. Ils restent néanmoins restrictifs, temporaires et, dans certains cas, mal compris. Les clients peuvent y adhérer avec des attentes irréalistes ou sans stratégie patrimoniale de long terme.

1. Des critères d’éligibilité stricts

De nombreux clients fortunés envisagent une expatriation à l’âge de la retraite, avec des revenus issus principalement de leur épargne, de pensions ou de portefeuilles d’investissement. Or, ce profil ne répond généralement pas aux exigences strictement liées à l’exercice d’une activité professionnelle imposées par des régimes comme ceux de la France, du Portugal ou de l’Espagne.

À titre d’exemple, le régime portugais NIR s’applique uniquement à des profils disposant de compétences spécifiques dans des secteurs étroitement définis. Il exclut par ailleurs les pensions étrangères du champ de l’exonération, lesquelles peuvent être imposées à des taux pouvant atteindre 53 %. Le régime français repose également sur des conditions complexes étroitement liées à l’emploi.

Le régime britannique FIG (Foreign Income and Gains) est le moins contraignant, mais il impose néanmoins une déclaration exhaustive des revenus et gains mondiaux. Pour les clients disposant de structures patrimoniales internationales complexes, cela peut générer des contraintes administratives et de conformité significatives.

2. Une durée d’application limitée

Ces régimes sont, par nature, temporaires. La durée des avantages fiscaux est limitée à :

À l’issue de cette période, les clients deviennent imposables sur leurs revenus et plus-values mondiaux, aux taux marginaux de droit commun. Ils peuvent également entrer dans le champ de l’imposition successorale ou patrimoniale sur l’ensemble de leurs actifs mondiaux. Pour un client ayant vocation à s’installer durablement dans le pays, ces régimes ne constituent donc qu’un avantage transitoire.

3. Les revenus et gains de source locale ne sont généralement pas couverts

La majorité des régimes ne s’appliquent qu’aux revenus et gains de source étrangère. Si l’Espagne, la France et le Portugal prévoient certaines exonérations sur les revenus professionnels, les revenus d’investissement domestiques et les plus-values de source locale sont souvent exclus des dispositifs préférentiels.

Les clients percevant des revenus locaux significatifs ou réalisant des cessions d’actifs domestiques peuvent ainsi constater que le régime offre une utilité pratique limitée.

4. La gestion des enjeux transfrontalières demeure essentielle

De nombreux clients fortunés conservent des liens internationaux, qu’il s’agisse d’actifs détenus à l’étranger, de bénéficiaires résidant dans d’autres juridictions ou de projets de mobilité future. Les régimes fiscaux des expatriés peuvent offrir un allègement temporaire, mais ils ne se substituent pas à une planification patrimoniale transfrontalière globale. Les conseillers doivent continuer à prendre en compte l’imposition des revenus, des plus-values et de la transmission du patrimoine dans l’ensemble des juridictions concernées.

Les régimes fiscaux spéciaux peuvent être attractifs, mais ils ne constituent pas une solution complète. Leurs critères stricts, leur caractère temporaire et leur champ d’application limité impliquent que les conseillers doivent aider leurs clients à planifier au-delà du régime. Les stratégies les plus robustes demeurent celles qu’utilisent les résidents de long terme, plutôt que de s’appuyer exclusivement sur des dispositifs incitatifs destinés aux nouveaux arrivants.

Les solutions patrimoniales adossées à l’assurance jouent ici un rôle important. Elles permettent aux clients d’assurer la portabilité, de gérer l’exposition fiscale transfrontalière et de maintenir la continuité de la planification à long terme, y compris après l’expiration des régimes préférentiels.

The UK introduced the Foreign Income and Gains (FIG) regime from 6 April 2025. It replaces the long-standing Remittance Basis of taxation and offers a simpler framework for qualifying new residents. The regime exempts foreign income and gains for the first four tax years, whether or not funds are brought into the UK.

General Eligibility Criteria

The FIG regime applies to individuals who become UK tax resident on or after 6 April 2025 and who have been non-resident for at least ten consecutive tax years. These individuals are referred to as “qualifying new residents”. To benefit, individuals must:

The FIG regime exempts foreign income and gains from UK tax for up to four consecutive tax years starting with the first year of UK tax residence. Funds can be brought into the UK without triggering tax.

Relief must be claimed annually. FIG applies only to income and gains arising within the four-year FIG window. Other reliefs apply to pre-arrival income and gains, including the Temporary Repatriation Facility (TRF) and Rebasing for capital gains tax.

Significant Changes to the UK Inheritance Tax (IHT) Regime

The UK’s wider reform landscape also includes substantial changes to the Inheritance Tax (IHT) regime, which took effect from 6 April 2025. These reforms move the system from a domicile-based model to a residency-based approach and abolish the previous domicile and deemed-domicile rules for IHT purposes.

The new framework provides far clearer rules on when individuals fall within the UK IHT net – a marked improvement on the uncertainty that historically surrounded non-domiciled status. The impact is particularly significant for internationally mobile clients.

Key points include:

The FIG regime is suitable for:

These clients gain a clear four-year window during which foreign income and gains are exempt from UK tax. The simplification of reporting and the freedom to bring funds into the UK without tax consequences offer meaningful planning advantages.

The FIG regime does not benefit:

These clients transition into worldwide taxation more abruptly. TRF and Rebasing may soften the change until the end of the 2027/28 tax year, but FIG does not extend to them.

Understanding the timing of residence, the four-year window and the interaction with TRF and Rebasing is essential for planning.

France’s inpatriate regime offers tax exemptions to attract skilled professionals relocating to France. Recent clarification by the French Tax Administration has widened access for individuals recruited in France if application occurred abroad. With benefits lasting up to eight years, the regime can offer meaningful relief on professional and foreign-source income.

Overview and Eligibility

The inpatriate regime, governed by Article 155 B of the French Tax Code, was introduced to encourage skilled individuals to relocate or return to France. It applies only to employees or managing directors appointed to a French company either:

A key development came on 11 August 2025, when the French Tax Administration aligned its position with recent case law. It confirmed that individuals who apply for a role from abroad and are then recruited by a French company may qualify as inpatriates – provided they meet all other conditions.

To qualify, two residence conditions must be met:

Tax Relief Available

When eligible, professionals may benefit from exemptions on:

The exemptions apply until 31 December of the eighth year following the year the individual becomes French tax resident.

Property Wealth Tax (Impot sur la Fortune Immobilière or “IFI”) Treatment

Inpatriates benefit from partial IFI relief. For the first five years, they are taxable only on French-situated property, mirroring the treatment applied to non-residents.

Insurance and Capitalisation Contracts

The location of the insurer is critical. A contract issued by a French insurer will not benefit from the 50% exemption on gains. A contract issued by an insurer located outside France may qualify.

Because insurers cannot verify a policyholder’s inpatriate status, they must withhold tax in full. Clients reclaim the excess through their annual tax return. Advisers must ensure clients understand both the administrative process and timing implications.

The regime can be valuable for:

The regime is less suitable for:

The inpatriate regime can be powerful, but careful assessment is essential. Advisers should:

The temporary nature of the regime reinforces the need for long-term, portable wealth planning solutions that continue to support clients beyond the eight-year window.

Le régime des impatriés offre des exonérations fiscales afin d'attirer les professionnels qualifiés qui s'installent en France. Une récente clarification de l'administration fiscale française a élargi l'accès à ce régime pour les personnes ayant candidaté depuis l’étranger et recrutées en France. Ce régime offre un allègement fiscal significatif sur les revenus professionnels et les revenus de source étrangère pour une durée de 8 ans.

Alix Devalmont et Nicolas Morhun expliquent les principales caractéristiques du régime des impatriés et présentent les considérations pratiques pour les conseillers qui accompagnent des clients à l'international.

Présentation générale et conditions d'éligibilité

Le régime des impatriés, régi par l'article 155 B du Code général des impôts, a été introduit afin d'encourager les professionnels qualifiés à s'installer ou à revenir en France. Il s'applique uniquement aux salariés ou aux cadres dirigeants recrutés dans une société française soit :

Par une évolution importante de sa doctrine intervenue le 11 août 2025, l’administration fiscal est venue aligner sa position avec la jurisprudence récente. Elle a confirmé que les personnes qui postulent à un emploi depuis l'étranger et qui sont ensuite recrutées par une société française entrent dans le champ d’application des « impatriés », à condition qu'elles remplissent toutes les autres conditions.

Pour être éligible, deux conditions de résidence doivent être remplies :

Exonérations fiscales

Lorsqu'ils remplissent les conditions requises, les professionnels « impatriés » peuvent bénéficier d'exonérations sur :

Les exonérations s'appliquent jusqu'au 31 décembre de la huitième année suivant l'année au cours de laquelle la personne est devenue résidente fiscale française.

Impôt sur la fortune immobilière (IFI)

Les impatriés bénéficient d'un allègement partiel de l'IFI. Pendant les cinq premières années, ils ne sont imposables que sur les biens situés en France, à l'instar du traitement appliqué aux non-résidents.

Contrats d'assurance-vie et de capitalisation

La localisation de l'assureur est déterminante : seuls les contrats émis par un assureur étranger bénéficieront de l'exonération de 50 % sur les plus-values. Un contrat émis par un assureur situés en France ne sera pas éligible.

Les assureurs ne pouvant vérifier le statut d’impatrié du souscripteur, ils doivent prélever l'intégralité de l'impôt dû en cas de rachat. Les souscripteurs récupèrent l'excédent via leur déclaration d’impôt annuelle. Les conseillers doivent s'assurer que leurs clients comprennent à la fois le processus administratif et les implications.

Ce régime peut être intéressant pour :

Le régime est moins adapté aux :

Le régime des impatriés peut être très avantageux, mais il est essentiel de l'évaluer avec soin. Les conseillers doivent :

La nature temporaire du régime renforce la nécessité de solutions de planification patrimoniale à long terme afin de sécuriser la situation des clients au-delà de la période de huit ans.

Portugal repealed the long standing Non-Habitual Resident (NHR) regime for new entrants with effect from 1 January 2024. However, a new special regime was introduced: the New Inpatriate Regime (NIR), often referred to as “NHR 2.0”. The NIR targets active professionals in high value-added sectors and offers a 20% flat rate on qualifying Portuguese source employment and self-employment income, alongside exemptions for most foreign source income.

General Eligibility Criteria

The NIR was introduced in the 2024 Portuguese State Budget and applies to individuals who become Portuguese tax resident from 2024 onwards. To qualify, individuals must:

Qualifying Activities and Entities

Qualifying activities must be performed for recognised entities, including:

Tax Treatment and Benefits

The NIR applies for 10 consecutive years. Portuguese-source employment and self-employment income that qualifies for the regime is taxed at a 20% flat rate.

Foreign-source income, including employment, self-employment, dividends, interest, rental income and capital gains, is exempt from Portuguese taxation, except for foreign pensions, which are never exempt.

The NIR is attractive for:

Clients with diversified global income streams often gain the most, as the combination of a 20% flat rate and broad foreign-income exemption can significantly reduce their tax exposure.

The NIR is not suitable for:

Foreign-source pensions are never exempt, so the regime offers limited benefit to clients whose main income is pension-based.

Given the narrow eligibility criteria, advisers should verify the client’s employment status, confirm the eligibility of the employer or entity, and assess whether the client’s overall global income profile is well-aligned with the structure and intent of the regime.

Portugal revogou o regime dos Residentes Não Habituais (NRH) de longa data para novos registos com efeitos a 1 de janeiro de 2024. No entanto, foi introduzido um novo regime especial: o Novo Regime de Impatriados (NRI), frequentemente referido como «RNH 2.0». O NRI destina-se a profissionais ativos em setores de elevado valor acrescentado e oferece uma taxa especial de 20% sobre os rendimentos provenientes de trabalho dependente e independente obtidos em Portugal, bem como isenções para a maioria dos rendimentos de origem estrangeira.

Mafalda Moura Cesário explica as condições do NRI e descreve quando o regime é uma opção a considerar para os clientes e quando o regime não se apresenta uma opção apelativa.

Critérios gerais de elegibilidade

O NRI foi introduzido no Orçamento do Estado português para 2024 e aplica-se a indivíduos que se tornem residentes fiscais em Portugal a partir de 2024. Os requisitos de qualificação para o NRI são os seguintes:

Atividades e entidades elegíveis

As atividades elegíveis devem ser desempenhadas para entidades reconhecidas, nomeadamente:

Tratamento fiscal e benefícios

O NIR aplica-se durante 10 anos consecutivos. Os rendimentos do trabalho dependente e independente obtidos em Portugal que qualifiquem para o regime são tributados a uma taxa especial de 20%.

Os rendimentos de origem estrangeira, incluindo rendimentos do trabalho dependente e independente , dividendos, juros, rendimentos prediais e mais-valias, estão isentos de tributação em Portugal, exceto as pensões estrangeiras, que nunca estão isentas.

O NRI é atraente para:

Os clientes com fontes de rendimento diversificadas são frequentemente os que mais beneficiam, uma vez que a combinação de uma taxa especial de 20% e uma ampla isenção de rendimentos estrangeiros pode reduzir significativamente a sua exposição fiscal.

O NRI não é adequado para:

As pensões de origem estrangeira nunca são isentas, pelo que o regime oferece benefícios limitados aos clientes cujos rendimentos principais provêm de pensões.

Dados os critérios de elegibilidade restritos, os mediadores de seguros devem verificar a situação profissional do cliente, confirmar a elegibilidade do empregador ou entidade e avaliar se o perfil global de rendimentos do cliente está bem alinhado com a estrutura e a intenção do regime.

Italy introduced its Flat Tax Regime in 2017 to attract internationally mobile high-net-worth individuals. The regime allows eligible new residents to pay a fixed annual tax on foreign-source income instead of ordinary progressive taxation. Recent increases to the flat tax amount – from €100,000 to €200,000 and now €300,000 from 2026 – make understanding its long-term suitability even more important.

Eligibility and Scope

The regime is available to individuals who have not been Italian tax resident for at least nine of the ten years prior to relocation. Once elected, it can apply for up to 15 years, providing long-term predictability. The option may be extended to family members, who each pay an additional annual flat tax.

Eligibility is typically confirmed through a ruling request (interpello) submitted to the Italian Tax Authority. Once approved, the annual flat tax is paid through the standard Italian income tax return.

Tax Benefits Available

Qualifying individuals pay a fixed annual amount on all foreign-source income, irrespective of its level, nature or complexity. As of 2026, this annual tax is €300,000. Italian-source income remains taxable under normal rules.

The flat tax regime also grants a full exemption from Italian inheritance tax on foreign-situated assets. This can be a significant advantage for clients with cross-border estates or succession planning objectives.

The regime suits individuals who:

For these clients, the fixed-tax structure offers certainty and simplicity when managing cross-border revenues and complex wealth structures.

The flat tax regime is less appropriate for individuals who:

Advisers should take particular care when working with clients whose income mix may change over time.

Advisers should evaluate:

For clients planning to remain in Italy after the 15-year period, advisers should also consider potential exit strategies or evaluate the impact of returning to ordinary taxation. For clients considering future relocation, advisers should assess the cross-border implications of unwinding or maintaining their Italian tax residence.

L'Italia ha introdotto il regime fiscale forfettario nel 2017 per attrarre persone high-net-worth con mobilità a livello internazionale. Il regime consente ai nuovi residenti, qualora idonei, di pagare un'imposta annuale fissa sui redditi di fonte estera al posto della normale imposizione progressiva. I recenti aumenti dell'importo dell’imposta forfettaria - da 100.000 euro a 200.000 euro e ora a 300.000 euro a partire dal 2026 - rendono ancora più importante comprenderne l’adeguatezza per il lungo termine.

Filippo Mancini spiega come funziona il regime fiscale italiano con imposta forfettaria, delinea chi beneficia del regime e illustra le considerazioni chiave per i consulenti che assistono clienti con mobilità internazionale.

Ammissibilità e ambito di applicazione

Il regime è disponibile per le persone fisiche che non siano state residenti fiscali in Italia per almeno nove dei dieci anni precedenti al trasferimento. Una volta scelto, può essere applicato per un massimo di 15 anni, garantendo una certa prevedibilità sul lungo termine. L'opzione può essere estesa ai membri della famiglia, i quali pagano ciascuno un'imposta fissa annuale aggiuntiva.

L'idoneità viene generalmente confermata tramite una richiesta di interpello presentata all'Agenzia delle Entrate italiana. Una volta approvata, l'imposta fissa annuale viene pagata tramite la normale dichiarazione dei redditi italiana.

Agevolazioni fiscali disponibili

Le persone fisiche che soddisfano i requisiti pagano un importo fisso annuale su tutti i redditi di fonte estera, indipendentemente dal loro livello, natura o complessità. A partire dal 2026, questa imposta annuale sarà pari a 300.000 euro. I redditi di fonte italiana rimangono tassabili secondo la tassazione ordinaria.

Il regime forfettario garantisce anche l'esenzione totale dall'imposta di successione italiana sui beni situati all'estero. Ciò può rappresentare un vantaggio significativo per i clienti con patrimoni transfrontalieri o obiettivi di pianificazione successoria.

Il regime è adatto a persone fisiche che:

Per questi clienti, la struttura fiscale fissa offre certezza e semplicità nella gestione dei redditi transfrontalieri e delle strutture patrimoniali complesse.

Il regime fiscale forfettario è meno adatto alle persone che:

I consulenti dovrebbero prestare particolare attenzione quando lavorano con clienti il cui mix di reddito potrebbe cambiare nel tempo.

I consulenti dovrebbero valutare:

Per i clienti che intendono rimanere in Italia dopo il periodo di 15 anni, i consulenti dovrebbero anche prendere in considerazione potenziali strategie di uscita o valutare l'impatto del ritorno alla tassazione ordinaria. Per i clienti che stanno valutando un futuro trasferimento, i consulenti dovrebbero valutare le implicazioni transfrontaliere della cessazione o del mantenimento della residenza fiscale italiana.

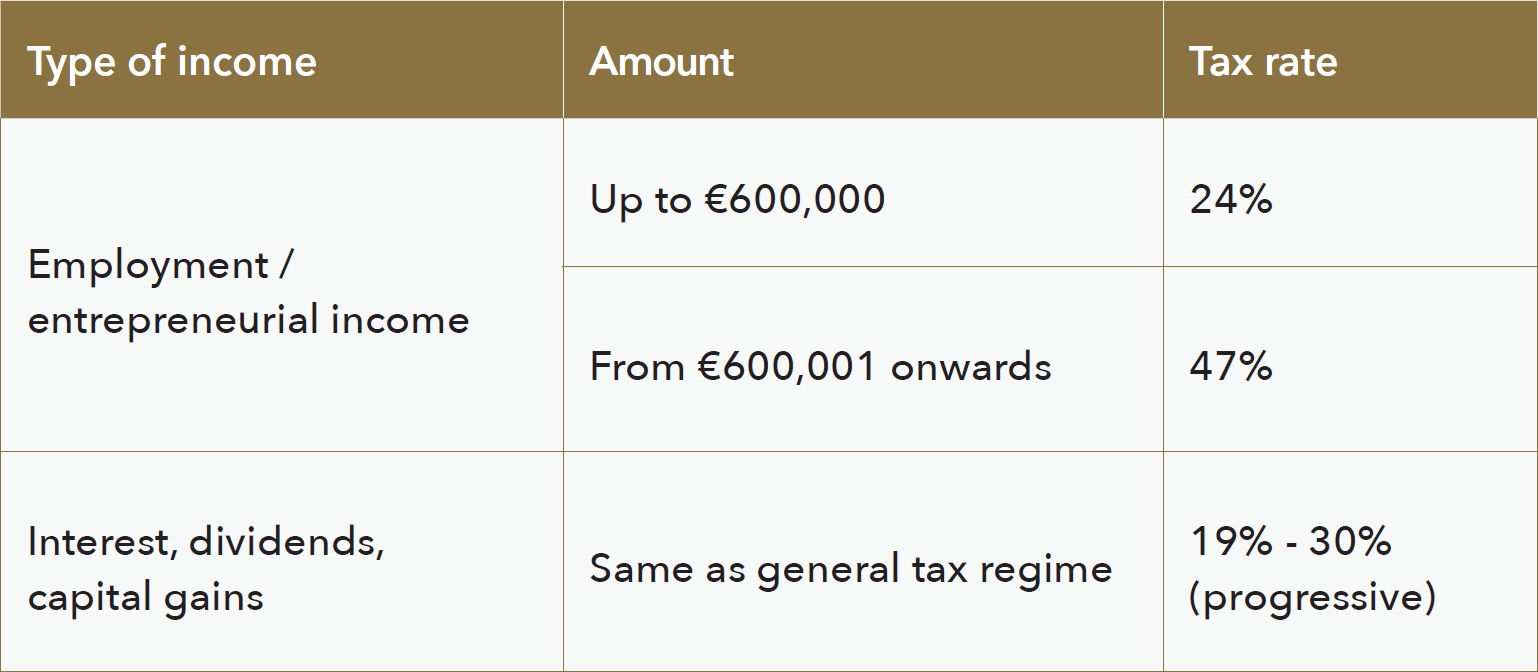

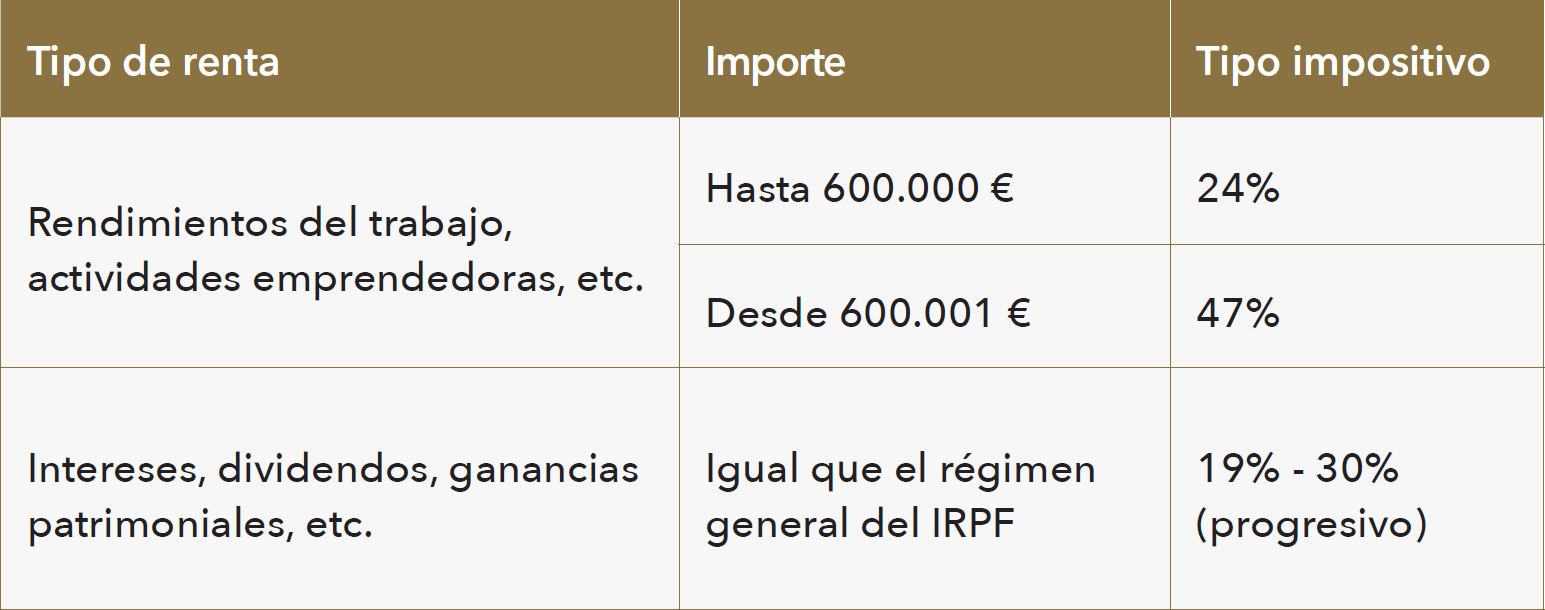

Spain’s Special Expatriate Tax Regime, known as the “Beckham Law”, allows qualifying individuals to be taxed as non-residents for six years. The regime provides a favourable framework for attracting highly skilled professionals to Spain, limiting taxation to Spanish-source income, gains and assets. Recent inspections indicate the Spanish Tax Agency is increasing scrutiny, making correct application essential.

Eligibility and Scope

The regime is governed by Article 93 of the Spanish Personal Income Tax Law. It allows individuals who become tax resident in Spain to be taxed as if they were non-resident. To qualify, applicants must:

Failure to meet these conditions prevents access to the regime or may lead to later regularisation.

Tax Benefits Available

The regime applies for six full tax years: the year of tax-residence acquisition plus five additional years. Key features include:

Tax Rates

Family members (e.g. spouse, children under 25, or any age if disabled) may join the regime if they relocate with the taxpayer, meet some qualifying conditions and have lower taxable income.

The Beckham Law is designed for:

It is especially beneficial for clients whose non-Spanish income and gains are substantial, as most foreign-source income remains outside the Spanish tax net.

The regime is less appropriate for:

When advising clients on the Beckham regime, advisers should consider:

Recent increases in inspections show the Spanish Tax Agency is closely examining artificial arrangements, mis-structured employment activities and incomplete documentation. Advisers should ensure clients maintain strong evidentiary support for their relocation and activities.

El régimen especial de tributación para impatriados, conocido como “Ley Beckham”, permite a los contribuyentes que cumplan determinados requisitos tributar como no residentes durante seis años. Este régimen ofrece un marco fiscal favorable para atraer a profesionales altamente cualificados a España, limitando la tributación a los ingresos, ganancias y activos de fuente española. En la actualidad, la Agencia Tributaria española está intensificando las inspecciones relacionadas con este régimen especial, por lo que es esencial realizar una correcta aplicación del mismo.

Nerea Llona y Ester Carbonell van Reck explican cómo funciona la “LeyBeckham”, para quién está diseñada, y qué deben tener en cuenta los asesores.

Requisitos y ámbito de aplicación

El régimen especial se rige por el artículo 93 de la Ley del Impuesto sobre la Renta de las Personas Físicas (IRPF). Permite a las personas que se convierten en residentes fiscales en España tributar como si fueran no residentes. Para poder acogerse al mismo, los solicitantes deben:

El incumplimiento de cualquiera de estas condiciones impide el acceso al régimen especial o puede dar lugar a una regularización posterior del mismo.

Ventajas fiscales

El régimen especial se aplica durante seis ejercicios fiscales completos: el año de adquisición de la residencia fiscal más cinco años adicionales. Las características principales de su tributación son las siguientes:

Tipos impositivos

Los familiares (por ejemplo, cónyuge, hijos menores de 25 años o de cualquier edad si son discapacitados) también pueden acogerse al régimen especial si se trasladan con el contribuyente, cumplen determinadas condiciones, y tienen una base imponible inferior.

La “Ley Beckham” está diseñada para:

El régimen especial es especialmente beneficioso para clientes cuyos ingresos y ganancias de fuente extranjera son sustanciales, ya que la mayoría de los ingresos de origen extranjero quedan fuera del alcance impositivo.

Por otro olado, este régimen especial no es adecuado para:

Al asesorar a los clientes sobre la “Ley Beckham”, los asesores deben tener en cuenta:

El reciente aumento de las inspecciones demuestra que la Agencia Tributaria española está examinando de cerca las estructuras artificiales, las actividades laborales mal estructuradas, y la documentación incompleta. Los asesores deben asegurarse de que los clientes mantengan pruebas sólidas que respalden su desplazamiento y sus actividades.

For globally mobile clients, wealth planning becomes more complicated each time they move. Structures that worked well in one country may not fit local definitions in another. Even simple products, such as pensions or mutual funds, may fail to qualify for favourable treatment. More complex arrangements can trigger anti-roll up rules, leading to punitive tax charges, denial of reliefs and higher reporting obligations.

Classification Challenges Across Jurisdictions

When a client relocates, local authorities may view a structure differently from the country in which it was established. Definitions of qualifying investments vary, which can create immediate issues with recognition and taxation. Anti-roll up rules can also attribute underlying income and gains to the beneficial owner, resulting in higher tax and increased compliance obligations.

Why Portability Matters

Portability ensures that wealth structures continue to work when clients settle in a new jurisdiction. A robust portable plan aims to answer four essential questions with a “yes”:

For advisers, portability supports long term client retention. It reduces the risk of losing a client to a local adviser or being forced to unwind structures that no longer qualify.

Insurance-based planning is widely recognised across Europe and beyond. It occupies its own tax position in law, often more favourable than the taxation of direct investments. Its key advantages include:

Unit-linked insurance can also change how underlying investments are treated for tax purposes. However, the portability of an insurance structure is not automatic. Local rules differ, and recognition may depend on factors such as biometric risk levels, eligible investment types and succession law requirements.

A portability assessment ensures that an existing policy remains compliant in the new jurisdiction. Key areas for review include:

Properly executed, these adjustments preserve tax efficiency, recognition and the long-term integrity of the client’s plan.

As expat regimes tighten across Europe, clients face increasing uncertainty when relying on short term tax incentives. Portability offers a stable alternative. It protects clients from shifting political landscapes and ensures their wealth is structured in a way that works in every jurisdiction, not just the one they happen to live in today. This is why it matters to work with an insurer that understands international mobility.

Utmost combines global reach with deep local technical expertise, giving advisers confidence that their clients’ plans remain compliant, adaptable and effective wherever life takes them.

Pour les clients à forte mobilité internationale, la planification patrimoniale se complexifie à chaque changement de pays. Des structures efficaces dans une juridiction peuvent ne plus correspondre aux définitions locales dans une autre. Même des produits simples, tels que les pensions ou les fonds d’investissement, peuvent ne plus bénéficier d’un traitement fiscal favorable. Des dispositifs plus complexes peuvent déclencher des règles anti-capitalisation, entraînant des impositions pénalisantes, la perte d’avantages fiscaux et des obligations déclaratives accrues.

Brendan Harper explique pourquoi la portabilité est essentielle pour les clients qui changent de juridiction et pourquoi les conseillers ont besoin de solutions qui restent conformes et efficaces dans chaque pays.

Défis de qualification entre juridictions

Lorsqu’un client change de pays de résidence, les autorités locales peuvent qualifier une structure différemment de la juridiction dans laquelle elle a été mise en place. Les définitions des investissements éligibles varient, ce qui peut créer des difficultés immédiates en matière de reconnaissance et de fiscalité. Les règles anti-capitalisation peuvent également imputer les revenus et gains sous-jacents au bénéficiaire effectif, entraînant une imposition plus élevée et des obligations de conformité renforcées.

Pourquoi la portabilité est essentielle

La portabilité permet aux structures patrimoniales de continuer à fonctionner lorsque les clients s’installent dans une nouvelle juridiction. Une planification véritablement portable doit pouvoir répondre positivement à quatre questions essentielles :

Pour les conseillers, la portabilité favorise la rétention des clients à long terme. Elle réduit le risque de perdre un client au profit d’un conseiller local ou d’être contraint de démanteler des structures qui ne seraient plus reconnues.

La planification patrimoniale adossée à l’assurance-vie est largement reconnue en Europe. Elle bénéficie d’un régime fiscal spécifique en droit, souvent plus favorable que celui applicable aux investissements détenus en direct. Ses principaux avantages incluent :

Les contrats d’assurance-vie en unités de compte peuvent également modifier le traitement fiscal des investissements sous-jacents. Toutefois, la portabilité d’une structure d’assurance-vie n’est pas automatique. Les règles locales diffèrent et la reconnaissance peut dépendre de facteurs tels que le niveau de risque biométrique, les types d’investissements éligibles ou les exigences en matière de droit successoral.

Une analyse de portabilité permet de vérifier qu’un contrat existant reste conforme dans la nouvelle juridiction. Les principaux éléments à examiner comprennent :

Lorsqu’ils sont correctement mis en œuvre, ces ajustements permettent de préserver l’efficience fiscale, la reconnaissance juridique et l’intégrité du dispositif de planification à long terme.

À mesure que les régimes fiscaux applicables aux expatriés se durcissent en Europe, les clients sont confrontés à une incertitude croissante lorsqu’ils s’appuient sur des incitations fiscales de court terme. La portabilité constitue une alternative stable. Elle protège les clients contre l’évolution des environnements politiques et garantit que leur patrimoine est structuré de manière efficace dans chaque juridiction, et non uniquement dans celle où ils résident à un instant donné. C’est pourquoi il est essentiel de travailler avec un assureur qui maîtrise la mobilité internationale.

Utmost associe une présence internationale à une expertise technique locale approfondie, offrant aux conseillers l’assurance que les dispositifs de leurs clients restent conformes, adaptables et efficaces, quel que soit leur parcours de vie.

In a market shaped by rising regulation, rapid technology change and client mobility, choosing the right life company is critical. Life policies endure for decades and underpin multi-generational planning, so early exits can trigger tax consequences and disrupt strategies.

In this interview, Aidan Golden speaks with Paul Thompson, CEO of Utmost, on what defines a resilient life company. Marking ten years since the Utmost brand launch, Paul shares insights on financial strength, technical expertise and strategic commitment, and outlines three trends set to shape the industry in 2026 and beyond.

AG: Paul, Utmost has built a reputation for strength and reliability in the international life market. What do you think sets us apart from other providers?

PT: For me, it’s two things: financial strength and technical capability. Clients and advisers need confidence that the life company they select will be there for the long term and Utmost ticks that box. Beyond that, we have the expertise to handle the most complex cases which can often include multi-jurisdictional planning, alternative assets and bespoke tax structuring. These are the areas where we excel and that combination of stability and technical depth is key.

AG: When you talk about “complex cases” what does that mean in practice?

PT: Well, to start, true simplicity is becoming rare. In recent years, almost every case we see carries some element of complexity. Clients are increasingly internationally mobile with assets and family members spread across multiple jurisdictions. Others use sophisticated trust structures or have plans to relocate, which introduces layers of tax and regulatory considerations. These scenarios often involve significant sums and demand absolute precision. That’s where our technical team comes in as we work with clients and advisers to design solutions that are robust and tailored to each objective. It’s never just about issuing a policy; it’s about engineering the right outcome for the long term.

AG: Knowing what you know about life companies from the inside, what are the key focus points for choosing a provider?

PT: It’s one of the most important decisions an adviser or client will make. These policies are long-term commitments over 15, 20 years or more and exiting early can trigger unplanned tax consequences. The choice of provider must be evidence-based. Look beyond the marketing gloss and focus on two things: financial strength and strategic intent. These are the foundations of reliability.

AG: So, size and strength are the key factors?

PT: Absolutely. Think of it this way: when you are entrusting a provider with your clients’ assets, why take an unrewarded risk? Choosing a financially weaker insurer offers no upside and only greater downside exposure. By contrast, Utmost’s financial strength is independently validated. Each of our insurance companies individually holds a Fitch A+ Insurer Financial Strength rating, a clear external endorsement of our stability and our ability to meet policyholder commitments over the long term.

Many other insurance providers in our markets depend on a parent company rating or a point-in-time guarantee of their support. That raises legitimate questions about long-term commitment and structure. These are questions advisers increasingly need to be prepared to answer.

When you combine our A+ Fitch ratings with the wider Utmost Group fundamentals including a strong solvency coverage position and more than £100bn in assets under administration the picture becomes even clearer. Utmost has the scale, robustness and financial discipline to deliver for clients not just today, but for decades to come. In today’s environment, regulators and PI insurers will expect advisers to justify their choice so why take a risk?

AG: What are your thoughts on how important investment in the business is? Why does this matter?

PT: Investment is critical. Servicing a policy isn’t just about issuing it today and forgetting about tomorrow. A life company needs to commit to potentially supporting clients for decades. That means handling assignments or changes of custodian or investment strategy as well as assessing portability when clients move countries. Companies that don’t invest or aren’t core to their parent group often suffer from a lack of functionality. Investment in systems, people and processes is non-negotiable and sits at the heart of our strategy in Utmost.

AG: These products can be perceived as expensive. How do you respond to that?

PT: The benefits which include tax efficiency, succession planning and investment growth are significant, but delivering them comes at a cost. Life companies are expensive to run because they need to maintain solvency margins, provide accurate administration and ensure compliance across multiple jurisdictions and with international regulators. In the last decade, the need for investment in technology and cyber security has increased tenfold. Add to that the need for highly qualified technical teams covering the tax and regulatory aspects of all our international markets and products and you can see why ongoing investment is essential.

AG: And profitability? How do you balance that with investment?

PT: Like any commercial business, we need to make a profit for shareholders – but the key is balance. We reinvest heavily to ensure long-term sustainability. That’s why profitability matters as it gives us the ability to invest today and the strategic intent to keep building for the future.

AG: Looking ahead, what do you see shaping the future of international life assurance?

PT: As we turn the page and move into 2026, three big themes stand out. First, the rise of alternative investments, as clients increasingly look beyond traditional asset classes. Life companies must ensure flexibility and robust governance to accommodate these strategies safely. Second, the influence of artificial intelligence. AI is already transforming how we process data, assess risk and deliver personalised solutions. It will enable faster, smarter decision-making, but it also raises questions about transparency and ethical use, which we take very seriously. Finally, the need for security and technology investment will only intensify. Cyber threats are evolving, regulatory demands are increasing and clients expect seamless and compliant engagement and for the data to be safe with us.

Dans un marché marqué par un renforcement de la réglementation, une évolution technologique rapide et une mobilité accrue des clients, le choix de la bonne compagnie d’assurance-vie est déterminant. Les contrats d’assurance-vie s’inscrivent dans la durée et soutiennent une planification patrimoniale multigénérationnelle ; une sortie anticipée peut entraîner des conséquences fiscales et perturber les stratégies mises en place.

Dans cet entretien, Aidan Golden s’entretient avec Paul Thompson, CEO d’Utmost, sur les caractéristiques d’une compagnie d’assurance-vie résiliente. À l’occasion des dix ans de la marque Utmost, Paul partage sa vision de la solidité financière, de l’expertise technique et de l’engagement stratégique, et présente trois tendances qui façonneront le secteur à partir de 2026.

AG : Paul, Utmost s’est forgé une réputation de solidité et de fiabilité sur le marché international de l’assurance-vie. Qu’est-ce qui, selon vous, nous distingue des autres acteurs ?

PT : Pour moi, deux éléments sont déterminants : la solidité financière et la capacité technique. Les clients et les conseillers doivent avoir la certitude que la compagnie qu’ils choisissent sera présente sur le long terme, et Utmost répond clairement à cette exigence. Au-delà de cela, nous disposons de l’expertise nécessaire pour traiter les situations les plus complexes, qui impliquent souvent une planification multi-juridictionnelle, des actifs alternatifs et des structurations fiscales sur mesure. C’est dans ces domaines que nous excellons, et cette combinaison de stabilité et de profondeur technique est essentielle.

AG : Lorsque vous évoquez des « situations complexes », qu’entendez-vous concrètement ?

PT : La simplicité devient rare. Aujourd’hui, presque chaque dossier présente une forme de complexité. Les clients sont de plus en plus mobiles à l’international, avec des actifs et des membres de leur famille répartis dans plusieurs juridictions. D’autres utilisent des structures de trusts sophistiquées ou envisagent une expatriation, ce qui ajoute des couches de considérations fiscales et réglementaires. Ces situations portent souvent sur des montants significatifs et exigent une précision absolue. C’est là que notre équipe technique intervient, en travaillant avec les clients et les conseillers pour concevoir des solutions robustes et adaptées à chaque objectif. Il ne s’agit jamais simplement d’émettre un contrat, mais de construire un dispositif durable.

AG : Fort de votre expérience interne du secteur, quels sont selon vous les critères clés pour choisir une compagnie d’assurance-vie ?

PT : C’est l’une des décisions les plus importantes pour un conseiller ou un client. Ces contrats représentent des engagements de long terme, sur 15, 20 ans ou plus, et une sortie anticipée peut générer des conséquences fiscales non prévues. Le choix du prestataire doit reposer sur des éléments objectifs. Il faut dépasser le discours marketing et se concentrer sur deux fondamentaux : la solidité financière et l’intention stratégique. Ce sont là les fondements de la fiabilité.

AG : La taille et la solidité sont donc déterminantes ?

PT : Absolument. Préférez-vous confier vos actifs à une compagnie disposant d’une solidité financière démontrée, ou prendre un risque inutile avec un acteur plus fragile ? Il n’y a aucun avantage à choisir une compagnie moins robuste, uniquement un risque accru. Chez Utmost, notre notation Fitch A+ (Forte) constitue une preuve indépendante et claire de cette solidité. Associée à un ratio de solvabilité du Groupe sain et à plus de 100 milliards de livres sterling d’actifs sous administration, elle nous confère l’envergure et la résilience nécessaires pour accompagner nos clients sur le long terme. Dans le contexte actuel, les régulateurs et les assureurs en responsabilité professionnelle attendront des conseillers qu’ils justifient leurs choix.

AG : Quelle importance accordez-vous à l’investissement dans l’entreprise ?

PT : L’investissement est essentiel. Servir un contrat ne consiste pas à l’émettre aujourd’hui puis à l’oublier. Une compagnie d’assurance-vie doit être en mesure d’accompagner ses clients pendant plusieurs décennies. Cela implique de gérer des cessions, des changements de dépositaire ou de stratégie d’investissement, ainsi que d’évaluer la portabilité lorsque les clients changent de pays. Les entreprises qui n’investissent pas ou qui ne sont pas au cœur de la stratégie de leur groupe manquent souvent de fonctionnalités. L’investissement dans les systèmes, les équipes et les processus est non négociable et constitue le socle de notre stratégie chez Utmost.

AG : Ces solutions sont parfois perçues comme coûteuses. Comment réagissez-vous à cela ?

PT : Les avantages offerts, efficience fiscale, planification successorale, croissance des investissements, sont significatifs, mais leur mise en œuvre a un coût. Les compagnies d’assurance-vie sont coûteuses à exploiter, car elles doivent maintenir des marges de solvabilité, assurer une administration précise et garantir la conformité dans de multiples juridictions et vis-à-vis des régulateurs internationaux. Au cours de la dernière décennie, les investissements en technologie et en cybersécurité ont été multipliés. À cela s’ajoute la nécessité de disposer d’équipes techniques hautement qualifiées couvrant les aspects fiscaux et réglementaires de l’ensemble de nos marchés et produits internationaux.

AG : Et la rentabilité ? Comment concilier rentabilité et investissement ?

PT : Comme toute entreprise commerciale, nous devons générer un profit pour nos actionnaires, mais tout est question d’équilibre. Nous réinvestissons massivement afin d’assurer notre pérennité à long terme. C’est pourquoi la rentabilité est essentielle : elle nous permet d’investir aujourd’hui et de poursuivre notre développement stratégique dans la durée.

AG : Pour conclure, quelles évolutions façonneront, selon vous, l’avenir de l’assurance-vie internationale ?

PT : À l’horizon 2026, trois grandes tendances se dégagent. Tout d’abord, la montée en puissance des investissements alternatifs, les clients recherchant de plus en plus des solutions au-delà des classes d’actifs traditionnelles. Les compagnies d’assurance-vie devront offrir flexibilité et gouvernance robuste pour accompagner ces stratégies en toute sécurité. Ensuite, l’impact de l’intelligence artificielle, qui transforme déjà la gestion des données, l’évaluation des risques et la personnalisation des solutions. Enfin, le besoin croissant de sécurité et d’investissement technologique. Les cybermenaces évoluent, les exigences réglementaires s’intensifient et les clients attendent des interactions fluides, conformes et sécurisées.

Asian high-net-worth families are embracing international insurance-based solutions as a smart way to manage cross-border wealth and succession. With global transparency rules and anti-avoidance measures tightening, staying compliant has never been more important. For families connected to high-tax countries like the UK or Australia, the risk of unexpected tax bills and residency complications is real.

The good news? Insurance-based strategies, backed by accurate residency assessments and strong documentation, offer a clear, compliant path to long-term wealth growth, while reducing the stress of tax surprises and audits.

The Common Reporting Standard (CRS) requires financial institutions and insurance providers to identify tax residency and report account details annually. Advisers should confirm residency, refresh self-certifications, and map controlling persons so policy records match beneficiary information. Annual reviews help capture life changes such as relocation or overseas education.

HNW families that have traditionally used offshore companies now face far more transparent reporting obligations and stricter economic substance requirements. Controlled Foreign Company (CFC) rules have tightened and are actively enforced in many jurisdictions. Families should revisit any additional filing requirements and ensure that tax declarations are accurate and defensible.

Instead of continuing to hold assets through offshore entities, an international insurance-based solution can be considered. These policies can accommodate bankable portfolios and even complex investments such as hedge funds and private equity. This approach mitigates CFC exposure and integrates succession planning, offering a compliant and efficient framework for long-term wealth management.

The PRC tax authority has recently used CRS data to trace offshore income and enforce back filings with interest. A key focus has been verifying the cost basis for capital gains and the details of cross-border transactions. Families without clear documentation often struggle to justify their reporting. Using a compliant insurance-based policy streamlines reporting and reduces administrative burdens, offering a structured and transparent framework.

Extended study, internships, or relocations can change tax residency outcomes. In the United Kingdom, periods of residence can bring worldwide estate considerations for inheritance tax. In Australia, satisfying one residency test may shift an individual into worldwide income taxation. Insurance-based solutions can be structured to provide liquidity and orderly proceeds for future liabilities, but only when residency is assessed up front and reviewed annually.

For families who split time between countries, day counts, purpose of presence, and ties such as accommodation and family matter. A simple mobility plan that tracks travel and sets thresholds helps avoid unintended personal residency and supports consistent treatment of policy values, contributions, and payouts.

For advisers, transparency first is the safest rule. Insurance-based solutions remain powerful tools for disciplined accumulation and succession, but they should sit inside a compliance framework that anticipates cross-border scrutiny. Education-related mobility deserves special attention, as families often make quick decisions about schooling without considering residency and estate consequences. Mobility should be documented and reviewed to keep personal tax positions clear.

Insurance-based solutions can deliver flexibility and intergenerational continuity when paired with accurate residency assessments, clean disclosures, and strong documentation. Families with UK or Australia links should plan for potential tax liabilities in advance and use policies to provide timing and liquidity.

A recent decision of the Paris Court of Appeal has clarified how French tax authorities may treat life policies held through irrevocable and discretionary trusts. The ruling confirms that such structures may fall outside the favourable French life insurance tax regime. Instead, distributions may be reclassified as indirect gifts subject to transfer duties.

For advisers supporting HNW expatriates relocating to France, the decision highlights both a material tax risk and a clear opportunity to reposition clients towards compliant international insurance-based wealth solutions.

The ruling arrives at a time when France continues to scrutinise foreign trust structures. Trusts remain common in many common-law jurisdictions, but they do not align naturally with French civil and tax law. As a result, HNW individuals who become French tax resident often encounter issues when long-standing arrangements meet French concepts of ownership, control and transmission.

Against this backdrop, the June 2025 judgment of the Paris Court of Appeal carries significant weight. It confirms that even well-established trust structures created abroad may be reassessed once the settlor or beneficiaries are French tax resident.

The case concerned a French tax resident who had created irrevocable and discretionary trusts under US law for the benefit of his descendants. On the same day, the trusts subscribed to life insurance policies issued by US insurers. The settlor was the insured, and the trusts acted as both policyholders and beneficiaries.

After the insured’s death, the insurers paid the death benefits to the trusts. The trustees then exercised their discretionary powers to distribute the proceeds to the beneficiaries. The beneficiaries claimed the payments should fall within the French life insurance tax regime, which applies when sums are received directly under a policy.

The French tax authorities disagreed. They treated the distributions as indirect gifts subject to transfer duties. Both the Court of First Instance and the Court of Appeal upheld this view.

The Court focused on the legal structure rather than the economic rationale. Three factors were decisive: