This briefing is designed for financial advisers only and should not be distributed to or relied upon by individual investors.

This briefing is designed for financial advisers only and should not be distributed to or relied upon by individual investors.

Welcome to the third edition of Navigator, your trusted source for international industry insights and updates on insurance-based wealth solutions.

In this edition, our Technical Spotlight section focuses on gifting. In an ever-changing tax and regulatory environment, clients need to plan robustly for the effective and tax-efficient transfer of wealth to preserve their family legacy across generations.

An insurance solution can be a valuable tool in ensuring assets are passed on efficiently whilst maintaining control over access. However, complex and evolving tax and regulatory regimes can make this area of planning as challenging and time-consuming as it is rewarding.

To help you steer your clients through the more complex areas of planning, our technical experts provide comprehensive insights on gifting in our key markets, and the role life insurance can play in effective wealth transfer strategies.

In the Case Study Insights section, we bring these planning opportunities to life, illustrating how an insurance solution can contribute to effective wealth transfer strategies.

Elsewhere, we keep you up to date with key fiscal changes in France, explore the impact of Inheritance and gift tax reductions announced in Spain and outline the evolving situation in Norway regarding tax rules for corporate policyholders.

As we explore the intricacies of gifting and wealth transfer in this edition, we aim to equip you with the knowledge and tools needed to approach these areas with confidence.

As always, our team is here to support you in delivering the best possible outcomes for your clients.

Aidan Golden

Head of Group Technical Services

On 30 January 2025, the Norwegian Ministry of Finance (MoF) proposed changes to the tax rules applicable to unit-linked life insurance policies. Under the proposal, the tax exemption method would no longer apply to companies' investments through unit-linked life insurance policies. Following strong push back to the proposal from several stakeholders, the MoF issued a letter on 24 March 2025, acknowledging a need to revise the proposal.

Since the last tax reform in 2019, Norwegian policyholders with policies that have a low insurance element (below 50%) have been taxed on accrued gains within the policy at the time of a withdrawal or surrender, based on the equity-to-bond ratio within the policy.

Norway follows an 80/20 rule, whereby the equity-to-bond ratio is tracked throughout the life of the policy:

Currently, corporate policyholders benefit from tax exemption on the equity portion, whereby only gains that are considered bond income are taxed upon a withdrawal or surrender.

The MoF’s proposal, set to take effect on 1 January 2026, would make all distributions and gains taxable, including those related to the equity portion that currently benefit from tax exemption. The MoF further proposes that these changes apply retroactively, covering all accrued unrealised gains as of 30 January 2025. The proposal is currently under consultation until 30 April 2025.

If implemented in its current form, corporate policyholders would lose the tax exemption but would still benefit from tax deferral until a payment out from the policy. Additionally, Norwegian policies would continue to offer other advantages, such as flexible asset management, simplified administration, and easy reporting. No changes to the taxation of policies held by individuals are foreseen.

Several stakeholders, including Finans Norge, have already submitted feedback to the proposal, highlighting that unit-linked policies are also used by corporate investors and that the proposed changes may be too broad. In light of this, they have questioned whether the removal of the exemption is appropriate in its current form.

In a response letter to Finans Norge dated 24 March 2025, the MoF clarified that the proposal was developed on the assumption that unit-linked policies are designed primarily for individual investors. It also noted that, under current rules, certain non-equity investments within these policies could benefit from the exemption method – a treatment not available if companies had invested directly.

The MoF has confirmed it will reassess the proposal in light of the feedback received. While no revised draft or updated timeline has been provided, this response indicates a more considered and consultative approach going forward.

For more details on the proposal by the Ministry of Finance (in Norwegian), please visit:

https://www.regjeringen.no/no/dokumenter/horing-endringer-i-skattereglene-for-verdipapirfond-og-fondskonto/id3085472/?expand=horingsbrev

For the letter of the Ministry of Finance (in Norwegian), please visit:

https://www.regjeringen.no/no/aktuelt/justering-av-horingsforslag-om-fondskonto/id3093434/

In autumn 2024, Finnish Prime Minister Petteri Orpo appointed the Room for Growth project to identify strategies for promoting sustainable economic growth in Finland. The project’s expert working group, led by Risto Murto, CEO of Varma Mutual Pension Insurance Company, submitted its final report to the Prime Minister on 28 February 2025.

The report presents 41 proposals across various domains, including:

There are several proposals in relation to taxation, including proposals to reform the inheritance and gift tax regime to reduce their impact on the transfer of family businesses on death.

At this stage, there is no proposal for a legislative change. The Government will discuss these proposals further in its mid-term policy review at the end of April.

For the latest press release from the Finnish Government Communications Department (in English), see

https://valtioneuvosto.fi/-/kasvuriihi-tyoryhma-suomen-kasvu-vaatii-uudistuvaa-yritysrakennetta-ja-osaamista?languageId=en_US

For the final report of the Room for Growth project (in Finnish only), see here:

http://urn.fi/URN:ISBN:978-952-383-710-2

For wealthy Belgian residents, inheritance planning is very complex but extremely important. Belgium is a country of two extremes when it comes to inheritance and gift tax.

On one hand, inheritance tax rates are very high. In certain cases, this tax between non-affiliated persons can amount to 80% of the value of the inheritance. Even in the direct line, high rates apply, which for relatively small inherited amounts already range from 27% to 30%, depending on the Belgian Region where the testator resides. The same issue exists in Luxembourg, especially if the resident has no spouse (or legal partner) or heirs in the direct line.

On the other hand, both countries have flexible legislation regarding gifts. Gifts of bankable assets must generally be done by a registered notary deed, which implies that, regardless of the amount of the gift, flat gift taxes will have to be paid. In Belgium, these taxes range from 3% (in the Flemish and Brussels Region) or 3.3% (in the Walloon Region) in the direct line, to 7% (in the Flemish and Brussels Region) or 7.7% (in the Walloon Region) in the non-direct line. In Luxembourg, the rates range from 1.8% to 14.4%, depending on the degree of kinship between the giver and the donee.

A second option for gifting bankable assets is to make an indirect gift, typically done by a bank transfer accompanied by a private donation document, which does not need to be registered. This indirect gift may thus be subject to 0% gift taxes, provided the donor survives the gift for at least 5 years in Belgium and 1 year in Luxembourg.

When assets are already invested in an insurance contract, a third option is to organise an insurance gift by assigning the rights of the insurance contract, which must be formalised in an addendum to the contract.

Belgian and Luxembourg civil law allows donors to attach conditions to the donation, enabling them to exercise a certain degree of control over the donated assets. A key question is how the donor can ensure the donee adheres to these conditions. In this context, the insurance contract can play a crucial role, especially through its beneficiary clause, which can be made irrevocable. This is known as the ‘accepting’ beneficiary clause in Belgian and Luxembourg law. Once the beneficiary accepts this clause, the policyholder cannot exercise their rights without the beneficiary's agreement.

As an adviser working with Belgian or Luxembourg resident clients, it is essential to prioritise inheritance planning when discussing the structure of the clients’ investment assets. Customised planning solutions are available, and insurance contracts can play a vital role in this process.

Given the complexity of this matter, it is highly recommended to consult a Belgian or Luxembourg tax/legal specialist who can summarise the various options available in light of your client's specific needs.

Case Study Insights

Read the case study ‘Efficient Inheritance Planning and Wealth Management for a Belgian Family’ to learn how the irrevocable beneficiary clause can be used in an insurance contract to maintain control over donated assets. This case study also examines the inheritance planning and wealth management strategy for the couple and their family.

Visit the Case Study Insights section below, or click here.

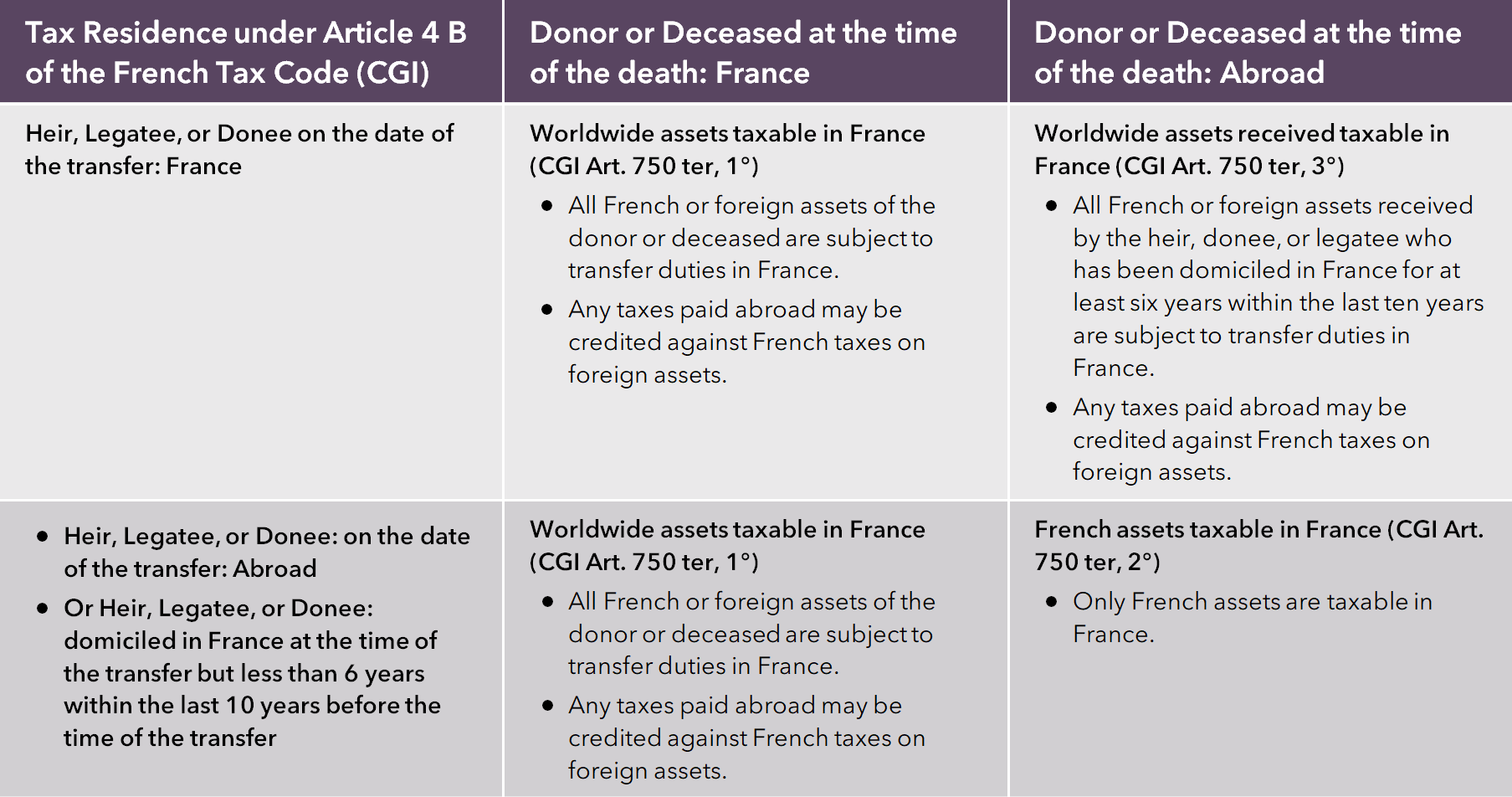

For internationally mobile UHNW families, wealth transfer planning is essential to minimise tax liabilities. The French tax system imposes different rules depending on the taxpayer’s residency status, making the timing of a gift a critical element in optimising tax efficiency.

To determine the applicable taxation for a gift in an international context, there is no difference as to whether the gift deed is executed in France or not.

France has few conventions on gift taxes with other countries (e.g., Germany, Austria, United States, Guinea, Italy, New Caledonia, Saint Pierre and Miquelon, Sweden). If a tax convention exists, the rules outlined in the convention will apply to determine in which country gift taxes may be due.

In the absence of a tax convention, French domestic law sets out the following principles:

To avoid the risk of double taxation in France and another state in the absence of a tax treaty, French domestic law provides for a foreign tax credit. The gift taxes paid abroad are then credited against the gift taxes due in France for movable and immovable property located outside of France.

Case Study Insights

To understand how this solution works, read the case study titled ‘A French Expatriate Family in Dubai’ in the Case Study Insights section below. This study highlights two potential solutions:

(1) gifting while residing in Dubai and (2) gifting after repatriation. It also demonstrates the substantial tax savings and benefits of using life insurance policies for wealth transfer.

Visit the Case Study Insights section below, or click here.

Strategic gifting prior to repatriation to France offers significant tax advantages, enabling expatriates to mitigate potential future liabilities. However, strict adherence to French tax regulations is crucial to avoid unintended tax consequences.

Advisers must guide clients through the intricacies of optimal wealth transfer strategies, ensuring compliance with reporting obligations while also helping to structure life insurance policies as effective vehicles for these donations.

This approach not only maximises tax efficiency but also provides long-term benefits by deferring tax once the family returns to France.

UK expatriates have always had to consider UK inheritance tax (IHT) in their succession and gifting strategies. However, as of 6 April 2025, UK IHT liability is now based on residency rather than domicile, offering new opportunities for expatriates to rethink and enhance their planning.

Historically, your domicile, not your residency, determined your exposure to UK IHT. For many UK expatriates, this meant that even after living abroad for many years, their UK domicile status continued to tie their worldwide assets to UK IHT. With the new rules, UK IHT liability is determined by whether or not you are considered a UK Long Term Resident (LTR).

To be considered LTR, an individual must have been UK resident for 10 out of the last 20 years. Therefore, someone who has left, or is leaving, the UK can be considered non-UK LTR when they have lived outside the UK for over 10 years. It could be as little as 3 years if they were UK resident for between 10 and 13 years, increasing by a year for every additional year they lived in the UK up to 20 years.

This means there is a large population of UK- domiciled individuals living long-term outside the UK who, from 6 April 2025, will require a different approach to how they structure their wealth and onward gifting and succession plans.

Even if an individual is non-UK LTR, UK-situs assets will still be subject to UK IHT. This means that reviewing existing UK assets is more important than ever. Could they be restructured to minimise IHT exposure, or is it time to move assets out of the UK? A simple option is to transfer these assets in-specie to an insurance-based wealth solution from an international provider.

Starting in April 2027, UK pensions will be subject to IHT, eliminating the IHT protection they previously enjoyed. A UK pension will be treated like any other UK asset for IHT. This presents an opportunity to revisit retirement plans. It may be beneficial to access UK pensions earlier than originally planned. For example, a non-LTR living in a tax-friendly jurisdiction with the right Double Tax Treaty with the UK (e.g., the UAE) could access their pension in full and utilise an insurance solution from an international provider to keep it out of the IHT net.

With UK IHT considerations potentially less of a concern, succession planning could be much simpler. For clients with straightforward needs, it may now be more cost-effective to use tools like life assurance bonds to nominate beneficiaries and pass on wealth without the added complexity of factoring exposure to UK IHT into their plans.

For clients with more complex succession planning requirements, the break between domicile and IHT can provide greater flexibility. Discretionary trusts become an attractive option, allowing clients to settle capital in trust without the previous barrier caused by treating such transfers as Chargeable Lifetime Transfers.

For those who have left the UK but haven’t yet reached the 10-year residency mark, a term assurance policy written in trust could be an effective solution. This would provide a tax-free lump sum that could be used to cover any potential UK IHT liability that may arise as a result of the individual’s death during the 10-year “tax tail.”

Key Actions for Advisers

By addressing key areas such as asset review, retirement planning, and succession options, advisers can develop more tailored, tax-efficient plans that align with the needs and aspirations of their expat clients.

Estate and tax planning involves balancing the timely and efficient transfer of wealth with maintaining control over how, and when, that wealth is accessed.

For those concerned about granting premature access to funds, or poor financial management by the recipient, an insurance-based wealth solution from an international provider with built-in restrictions offers a robust solution. Such policies can be effective for lifetime UK IHT planning and skipping a generation of tax between grandparents and grandchildren.

Utmost Wealth Solutions can offer these policies through its Luxembourg carrier (Lombard International Assurance SA, now part of Utmost Group), for policy premiums exceeding £1 million.

The restrictions made under this type of wealth solution fall under two parts:

These restrictions are set at inception and survive any subsequent assignment of the policy to an individual or trust, making it ideal for gifting wealth without handing over unrestricted access.

If a person subject to UK inheritance tax (IHT) gifts or transfers the policy to another individual or a bare trust, it is considered a Potentially Exempt Transfer, provided it is done outright and without consideration. This means that, if the transferor survives for 7 years after making the gift, the policy will be completely excluded from their estate for UK IHT purposes. Should the policyholder pass away within the 7-year period, taper relief may apply, which can significantly reduce the inheritance tax liability.

Using a bare trust results in no ongoing inheritance tax charges, such as exit or periodic charges that apply to a discretionary trust.

The key benefits are:

The flexibility to meet different concerns and needs of families, individual access requirements, and separate planning through multiple policies makes this a valuable tool in estate planning for advisers and their clients.

Case Study Insights

To learn how a client used an insurance solution with built-in restrictions to efficiently manage UK inheritance tax planning and ensure wealth is passed on to future generations while maintaining control over access, read ‘Effective UK Inheritance Tax Planning’ in the Case Study Insights section below, or click here.

For high-net-worth (HNW) families in China, preserving wealth across generations requires precision, foresight, and tools that transcend borders. With no gift or inheritance tax but stringent marital property rules and evolving global regulations, life insurance — paired with cross-border strategies — becomes essential for efficient, dispute-free wealth transfer.

Here’s how you can harness its power to protect your client’s legacy.

China’s Insurance Law grants life insurance unparalleled advantages:

Why It Matters for Your Clients: Utmost’s solutions enable seamless transfer of complex portfolios, ensuring your client’s wealth reaches heirs intact.

For globally mobile families, Singapore life insurance policies add an ironclad layer of protection:

Key Caveat: PRC courts may still scrutinise policies funded with marital assets. Mitigate risks by:

Pro Tip: Pair life insurance with a will that addresses dependents’ needs using other assets (e.g., real estate), insulating insurance from claims.

While China’s domestic trust industry evolves, overseas trusts remain the gold standard for HNW families:

Example: A Chinese entrepreneur funds a Singapore life insurance policy through a BVI-held trust, ensuring proceeds pass tax-free to children while bypassing PRC succession laws.

At Utmost, we specialise in turning complexity into clarity for families like your clients:

Secure Your Client’s Future Today

Don’t leave your client’s legacy to chance. Utmost’s wealth professionals can:

Contact your Utmost Wealth Solutions sales representative for expert support.

For those seeking optimal control and protection of their wealth while ensuring legacies are left to chosen heirs in a legally robust manner, structuring through an insurance-based wealth solution, such as Private Placement Life Insurance (PPLI), is an ideal planning tool.

Structuring a legacy through an insurance solution can differ significantly depending on whether the governing law of the policy is based on English common law or civil law. However, the Beneficiary Nomination framework in Singapore law provides a perfect combination of both systems, making it a unique jurisdiction for family wealth planning.

Introduced in 2009, the Nomination framework is enshrined in Part 3C of the Singapore Insurance Act and applies to any insurance policy issued by a Singapore authorised insurer subject to Singapore law. A valid nomination creates a separate estate that passes directly to beneficiaries without the need for probate or to apply the laws of succession or intestacy. This provides policyholders with legal certainty and contains provisions to effectively deal with conflicting claims between correctly appointed beneficiaries and the deceased’s estate, regardless of the domicile of the policyholder.

There are two ways in which insurance nominations can be constructed in Singapore: revocable or irrevocable.

A revocable nomination offers flexibility, allowing a policyholder to nominate any individual (whether related or not) or entity as a beneficiary.

The policyholder retains all rights to the policy during their lifetime, including the ability to take withdrawals or surrender the policy for their own benefit, add or remove nominated beneficiaries, or revoke the nomination without a replacement. The beneficiary has no right to the policy benefits until the death benefits are payable, leaving the policyholder in control of their wealth while ensuring a legacy will pass outside of their estate without complication upon their death.

Nominating an entity, such as a family trust, is particularly attractive for further planning. For example, a family trust could be nominated to receive the death benefits, ensuring controlled distribution without the complications of assigning the policy to the trust during the policyholder’s lifetime.

Also known as “Trust” nominations, irrevocable nominations are rooted in a long-standing feature of Singapore law, originally protected under s73 of the Conveyancing and Law of Property Act, which has its roots in the English Married Women’s Property Act 1882.

Irrevocable nominations can only be made in favour of the policyholder’s spouse and/or children.

However, a major benefit of such a nomination is that the policy remains outside of the policyholder’s estate, not only for succession purposes but also “for the purposes of his or her debts”. This includes protection against bankruptcy unless it is proven that the nomination was made with the deliberate attempt to defraud creditors. In such cases, creditors are entitled to claim an amount equal to the premiums paid to the policy.

This planning mechanism is useful for individuals who wish to shelter family legacies from unforeseen misfortune, such as entrepreneurs heavily invested in risky ventures. It can also provide a protected legacy to children unaffected by divorce.

A Trustee must be appointed to oversee the nomination. This can be the policyholder, either acting alone or another individual or entity. Unlike a revocable nomination, the beneficiary is entitled to both the death benefits and the living benefits, such as surrender or withdrawal proceeds.

The policyholder cannot make withdrawals from, surrender the policy, or revoke or amend the nomination without the consent of any beneficiary aged 18 or over, or their legal guardian (not being the policyholder) if they are minors. However, if another Trustee is appointed, these requests only require the Trustee’s consent, not the beneficiaries’ consent.

Despite appearing inflexible, irrevocable nominations offer interesting features:

These features provide an important element of flexibility should personal or family circumstances change in the future.

Case Study Insights

To learn how Singapore beneficiary nominations can protect family wealth and adapt to changing circumstances, read the case study ‘Singapore Beneficiary Nominations and Insurance-Based Wealth Solutions’ in the Case Study Insights section below, or click here.

In February, the president of Madrid, Isabel Díaz Ayuso, announced a new Inheritance and Gift Tax reform, which is estimated to benefit approximately 14,000 people in the region, fulfilling her electoral commitment of 2023.

Among the highlights of the proposal, the IHGT relief will increase from 25% to 50% for Group III beneficiaries, i.e., for inheritances and gifts between siblings, as well as between uncles/aunts and nieces/nephews by consanguinity. This greatly facilitates the transfer of wealth for those who do not have a partner or descendants, something that can be perfectly instrumented through a unit-linked life insurance policy, either on a whole of life or mixed term option, depending on the individual circumstances of each case.

This measure, which is unprecedented in Spain, will be added to the existing 99% tax relief for Group I and II beneficiaries (e.g., spouses, civil partners, ascendants and descendants). Once again, this will place Madrid at the top of the Autonomous Communities with the lowest taxes in Spain, offering clear advantages for estate and inheritance planning, especially for wealthy families.

Furthermore, this proposal includes a 100% exemption for gifts between individuals of less than €1,000 without the need for self-assessment. Additionally, for those gifts under €10,000, there would be no need to formalise them in a public deed for the application of Madrid's IHGT reliefs, clearly simplifying the procedures for the most frequent situations.

Although this announcement only marks the beginning of this initiative’s legislative process, as Ms. Díaz Ayuso currently has an absolute majority in the Assembly of the Community of Madrid, it is expected that it will go ahead in the coming months without obstacles.

Despite accusations of ‘tax dumping’ from the Spanish central government against Madrid and constant rumours about possible IHGT harmonisation in Spain, this announcement makes clear the president's commitment to the tax-cutting policies that have been in place for more than 20 years in Madrid. Criticism aside, the truth is that Madrid has managed to position itself as a leader in tax competitiveness in Spain and is currently the region with the highest GDP in the country.

This initiative is a clear invitation to review the succession planning of the people of Madrid, especially those who do not have a spouse or children.

In short, the new measures announced for Madrid make this the perfect timing to review families' estate and succession planning, and to consider how to take advantage of them when they are finally implemented.

All of this, together with the specific advantages that insurance-based wealth solutions can offer from a wealth transmission and succession point of view, constitutes the ideal scenario for clients who want to leave their estate planning organised and in a controlled manner for the next generations with sufficient peace of mind.

Case Study Insights

To understand how a controlled succession planning can be achieved with an insurance-based wealth solution in Spain, please read the case study ‘Gifting with Control in Spain’ in the Case Study Insights section below or click here.

El pasado mes de febrero, la presidenta de la Comunidad de Madrid, Isabel Díaz Ayuso anunció una nueva reforma del Impuesto sobre Sucesiones y Donaciones (ISD), la cual se estima podrá beneficiar a unas 14.000 personas en la región, cumpliendo así con su compromiso electoral de 2023.

Entre lo más destacado de la propuesta, se pretende elevar del 25% al 50% la bonificación del Impuesto sobre Sucesiones y Donaciones para los beneficiarios del Grupo III de parentesco, es decir, para sucesiones y donaciones entre hermanos así como entre tíos y sobrinos por consaguinidad, facilitando enormemente las transmisiones de patrimonio para todos aquellos que no tienen pareja o descendientes, algo que se puede instrumentar perfectamente a través de una póliza de seguro de vida unit-linked, bien en su modalidad de vida entera o mixta, dependiendo de las circunstancias particulares de cada caso.

Esta medida que es pionera en España, sumada a la ya existente bonificación del 99% para los beneficiarios del Grupo I y II de parentesco (p.ej. cónyuges, parejas de hecho, padres e hijos) hace que Madrid se coloque una vez más a la cabeza de las Comunidades Autónomas con impuestos más bajos de toda España, ofreciendo claras ventajas para la planificación patrimonial y sucesoria, especialmente para familias con un grandes patrimonios.

Asimismo, esta propuesta incluye una bonificación del 100% en el caso de donaciones entre particulares de menos de 1.000 euros sin necesidad de autoloquidación, y tampoco será necesario formalizar en escritura pública las donaciones de menos de 10.000 euros para la aplicación de las bonificaciones de la Comunidad de Madrid, simplificando claramente los trámites para las situaciones más frecuentes.

Si bien este anuncio únicamente supone el inicio de la tramitación de dicha iniciativa, al tener Díaz Ayuso la mayoría absoluta en la Asamblea de la Comunidad de Madrid, es es esperar que esta salga adelante en los próximos meses sin obstáculos.

A pesar de las acusaciones de “dumping fiscal” desde el gobierno central a la Comunidad de Madrid y de los constantes rumores acerca de una posible armonización del Impuesto sobre Sucesiones y Donaciones en España, este anuncio deja claro el compromiso de la presidenta con las rebajas impositivas que llevan sucediéndose desde hace más de 20 años en Madrid. Críticas aparte, lo cierto es que Madrid ha conseguido posicionarse como líder en competitividad fiscal en España y es en la actualidad la región con mayor PIB del país.

La iniciativa de la presidenta de la Comunidad de Madrid de impulsar una nueva rebaja fiscal del Impuesto sobre Sucesiones y Donaciones es una clara invitación a revisar la planificación sucesoria de los madrileños, sobre todo a aquellos que no tiene cónyuge o hijos.

En definitiva, las nuevas medidas anunciadas para Madrid hacen que este sea el momento idóneo para revisar la planificación patrimonial y sucesoria de las familias, y considerar el aprovechamiento de las mismas cuando sean finalmente implementadas.

Todo ello, unido a las ventajas específicas que los seguros de vida unit-linked pueden ofrecer desde el punto de vista de planificación patrimonial y sucesoria, establece el escenario ideal para los clientes que quieren dejar su sucesión organizada y controlada para las siguientes generaciones.

Caso Práctico

Para entender cómo se puede lograr una planificación sucesoria controlada con seguros de vida unit-linked en España, por favor lea el caso práctico ‘Gifting with Control in Spain’ (en inglés) en la sección ‘Case Study Insights’ a continuación o haga clic aquí:

The 2025 Budget Act introduces several fiscal adjustments that could reshape wealth management strategies. While life insurance maintains its favourable tax treatment, new fiscal constraints on high incomes and real estate investments may shift asset allocation.

CDHR: Minimum Taxation for High Incomes

The new Differential Contribution on High Incomes (CDHR) imposes a minimum tax rate of 20% on individuals earning over €250,000 and couples over €500,000. This is in addition to standard income tax and the Exceptional Contribution on High Incomes (CEHR). A 95% advance payment is required in December 2025, with final adjustments in 2026.

Increased Taxation on LMNP Real Estate

Capital gains taxation for non-professional furnished rentals (LMNP) is tightening. Effective February 15, 2025, previously deducted depreciation must now be reintegrated into the taxable base upon sale, significantly increasing tax liabilities.

Temporary Tax-Exempt Donations for New Home Purchases

Until 31 December 2026, family donations of up to €100,000 per donor (max €300,000 per beneficiary) for purchasing or constructing a primary residence will be exempt from transfer duties. The property must be held for at least five years. However, this measure lacks the long-term flexibility of life insurance, which allows structured wealth transfer with optimised taxation and liquidity.

Higher Transfer Taxes

French departments may raise real estate transfer duties by 0.5 percentage points from 1 March 2025 to 29 February 2028. This further diminishes the tax appeal of property investments compared to financial instruments like life insurance.

Stricter Taxation of Management Packages

Gains from management packages will now be taxed as capital gains up to three times the company's financial performance. Any excess will be reclassified as salary income and taxed up to 45%. While gains taxed as capital gains are exempt from social security contributions, those classified as salary income will incur a 10% sui generis contribution.

Clarified Tax Residence Rules for Non-Residents

A taxpayer classified as non-resident under an international tax treaty cannot be considered a French tax resident under domestic law. Additionally, non-residents can now reclaim excess withholding tax on securities capital gains, aligning with EU law.

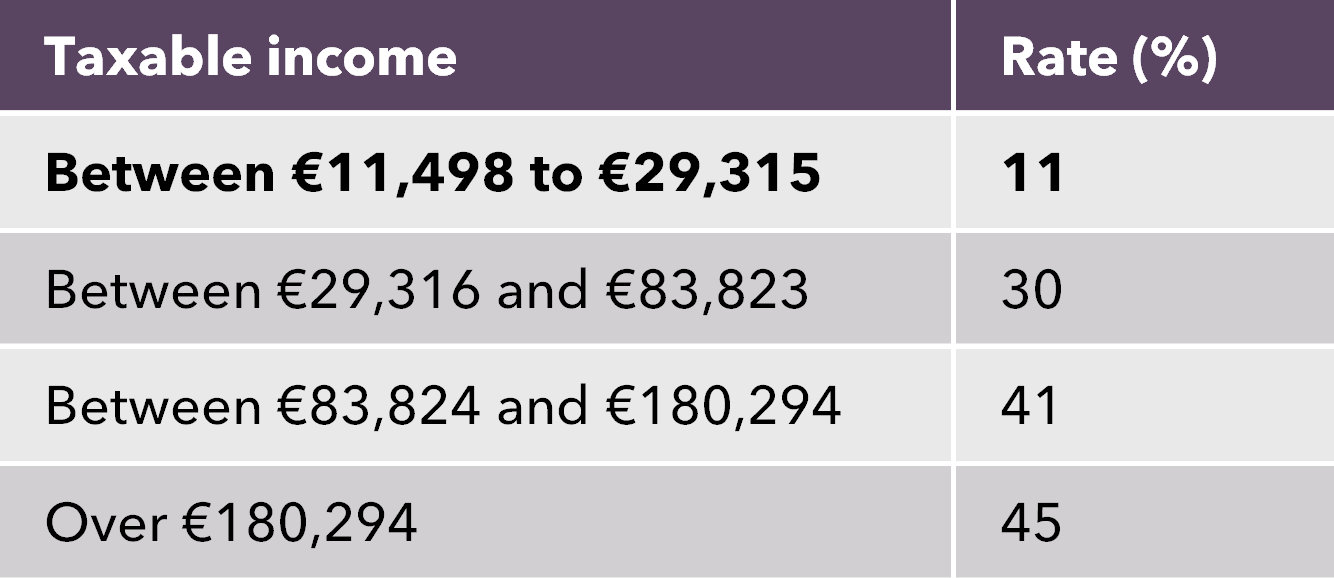

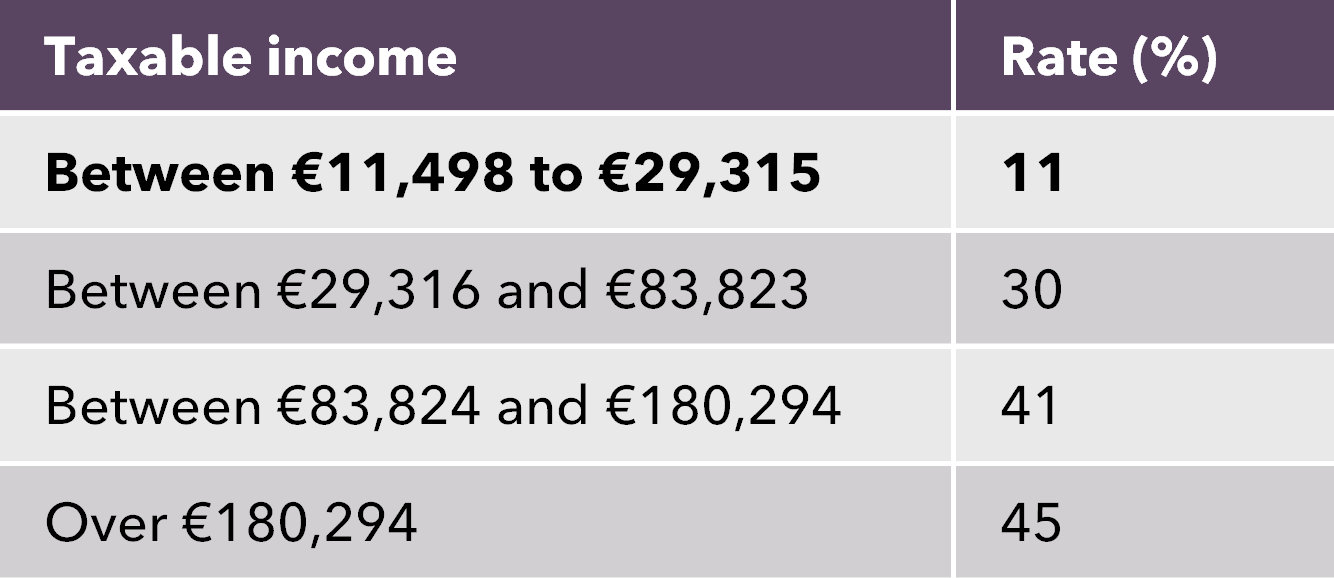

Adjusted Income Tax Scale

The progressive income tax scale is indexed by 1.8%, ensuring that inflation does not lead to automatic tax increases. While this measure does not directly impact life insurance, it helps limit the mechanical rise in taxation for some taxpayers.

The 2025 French Budget Act brings significant changes to wealth management, with higher taxes on high incomes, real estate and management packages. These new measures make life insurance an increasingly attractive tool for tax efficiency, asset diversification and wealth transfer strategies.

For an in-depth analysis of these changes and their impact on wealth structuring, read the detailed briefing below.

Download detailed briefingFor further insights on these regulatory changes and their implications for wealth planning, please contact your Utmost Wealth Solutions sales representative.

La Loi de finances 2025 introduit des évolutions fiscales majeures impactant les contribuables à hauts revenus, les investisseurs immobiliers et les stratégies de transmission de patrimoine. Entre l’instauration d’une taxation minimale sur les hauts revenus, le durcissement de l’imposition des plus-values pour les locations en meublé non professionnel (LMNP) et la refonte du régime fiscal des management packages, la planification patrimoniale en France évolue.

Dans ce contexte de pression fiscale accrue sur l’immobilier et les hauts revenus, l’assurance-vie s’impose plus que jamais comme un outil stratégique d’optimisation patrimoniale. Krystel Gillard explore l'impact de cette nouvelle loi sur la gestion de patrimoine en France.

La Loi de finances pour 2025 introduit plusieurs ajustements fiscaux susceptibles de remodeler les stratégies de gestion de patrimoine. Si l’assurance-vie conserve son cadre fiscal avantageux, le renforcement de la pression fiscal sur les hauts revenus et l’investissement immobilier en fait une solution privilégiée pour optimiser la gestion des actifs et la transmission de patrimoine.

CDHR : Une taxation minimale des hauts revenus

Une nouvelle Contribution Différentielle sur les Hauts Revenus (CDHR) instaure un taux d’imposition minimal de 20 % pour les contribuables percevant plus de 250 000 € (ou 500 000 € pour un couple). Cette contribution s’ajoute à l’impôt sur le revenu et à la Contribution Exceptionnelle sur les Hauts Revenus (CEHR).

Un acompte de 95% devra être versé en décembre 2025, avec une régularisation prévue en 2026.

Alourdissement de l’Imposition sur les Plus-Values en LMNP

Dès le 15 février 2025, le régime fiscal des locations meublées non professionnelles (LMNP) devient plus contraignant. La réintégration des amortissements déduits dans la base taxable lors de la revente entraînera une augmentation significative de la fiscalité pour les investisseurs.

Exonération temporaire de droits de donation pour l’acquisition d’un logement

Jusqu’au 31 décembre 2026, les donations familiales allant jusqu’à 100 000 € par donateur (dans la limite de 300 000 € par bénéficiaire) seront exonérées de droits de mutation si elles sont affectées à l’achat ou à la construction d’une résidence principale. Le bien devra être conservé pendant au moins cinq ans.

Toutefois, cette mesure reste limitée par rapport à l’assurance-vie, qui offre une transmission optimisée avec une fiscalité allégée et une liquidité préservée.

Hausse des droits de mutation

Entre le 1er mars 2025 et le 29 février 2028, les départements français pourront augmenter les droits de mutation de 0,5 point. Cette évolution réduit encore l’attractivité fiscale de l’immobilier par rapport à des placements financiers tels que l’assurance-vie.

Durcissement de la Fiscalité des Management Packages

Les gains issus des management packages seront désormais imposés au titre des plus-values mobilières, mais uniquement jusqu’à trois fois la performance financière de l’entreprise. Au-delà, ils seront requalifiés en traitements et salaires, avec une fiscalité pouvant atteindre 45%.

Les gains imposés en tant que plus-values restent exonérés de cotisations sociales, tandis que ceux requalifiés en revenus salariaux seront soumis à une contribution sui generis de 10%.

Clarification du statut fiscal des non-résidents

Un contribuable reconnu non-résident au titre d’une convention fiscale internationale ne pourra plus être considéré comme résident fiscal français au regard du droit interne. Par ailleurs, les non-résidents pourront désormais demander le remboursement du trop-perçu de prélèvements sur les plus-values mobilières, en conformité avec la réglementation européenne.

Indexation du barème de l’impôt sur le revenu

Le barème progressif de l’impôt sur le revenu est revalorisé de 1,8%, afin d’éviter une hausse automatique de l’imposition due à l’inflation.

La Loi de finances 2025 alourdit la fiscalité des hauts revenus, de l’immobilier locatif et des management packages, rendant plus que jamais nécessaire une approche patrimoniale adaptée. Dans ce contexte, l’assurance-vie se distingue comme un outil clé, offrant un cadre fiscal stable, une diversification des actifs et des solutions performantes pour la transmission du patrimoine.

Pour une analyse détaillée de ces évolutions et leurs implications, consultez l’article complet dans le PDF ci-joint.

Pour une analyse détaillée de ces évolutions et leurs implications, consultez l’article complet dans le PDF ci-joint.

Téléchargez l'article détailléPour toute question sur ces évolutions réglementaires et leur impact sur votre stratégie patrimoniale, contactez Marie Salvo, Head of Sales – France.

Repartition of rights1 is a traditional tool for wealth structuring in France. Following the introduction of article 774 bis of the French Tax Code, the clarifications provided by the French tax administration highlight and reinforce the advantages of insurance solutions when dealing with repartition of rights.

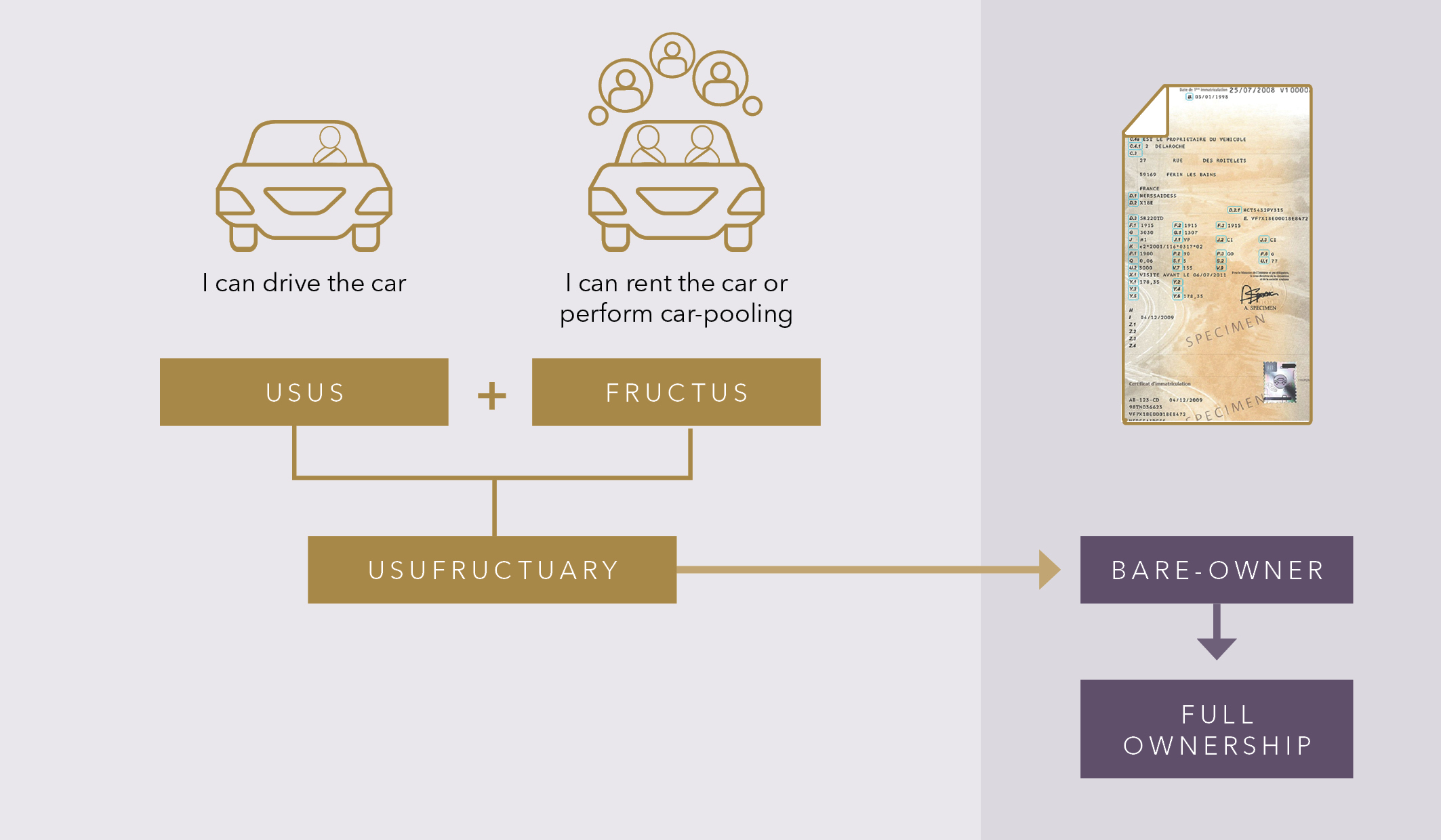

The concept of repartition of rights in French law is based on the distinction between different uses of an asset. When you can use an asset and receive the income it generates, you benefit from the “usufruct” and are the “usufructuary”2 of this asset. However, you do not own the asset, which belongs to the “bare owner.”3

For example, the usufructuary of a car can drive the car, receive rental fees, or earn income from carpooling. However, the car's value belongs to the bare owner.

When this concept is applied to fungible assets, such as money or life insurance death proceeds, a “quasi-usufruct” is created. This means the usufructuary can fully enjoy the assets but must refund the bare owner with identical assets. For money, the usufructuary can use it during their lifetime but is obliged to refund the bare owner upon their death. Legally, this obligation to refund constitutes a debt. Previously, this debt was fully deductible from the usufructuary's estate.

When gifting the bare ownership of an asset, the taxable basis for gift tax is limited to the value of the bare ownership.

Even if the repartition of rights is not set up for tax purposes, it results in the bare owner recovering full property of the assets at the usufructuary's death without additional gift or inheritance tax. The value of the usufruct is exempt from these taxes.

If the asset subject to repartition of rights is sold, the parties have several options:

While this debt was fully deductible in the past, Article 774 bis introduces some distinctions.

The deductibility of the debt depends on how the repartition of rights was created. There are three cases:

It is common to create a repartition of rights to life insurance death proceeds using a beneficiary designation. The French tax administration clarified that the creation of a quasi-usufruct debt via a beneficiary designation is excluded from the scope of Article 774 bis.

“The provisions of article 774 bis of the CGI concern restitution debts relating to a sum of money of which the deceased had reserved the usufruct. Consequently, these provisions do not apply to restitution debts relating to a sum of money of which the deceased held the usufruct when created (…) by the policyholder of a life insurance policy as the beneficiary in usufruct of the sums due on termination of the policy;”5

The tax administration also addressed questions related to the creation of a repartition of rights on a capitalisation contract.

The policyholder holds a debt against the insurance company, and the question was whether this debt should be treated as a sum of money and whether the quasi-usufruct created upon surrender would be deductible. The tax administration confirmed that the debt created following the surrender of the contract might be deductible if it was not done mainly for tax purposes.

Additionally, the French tax administration confirmed that reinvesting funds subject to repartition of rights into a capitalisation contract does not fall within the scope of Article 774 bis because no debt is created during this process. Instead, the repartition of rights is carried forward on the capitalisation contract.

To maintain the benefits of the repartition of rights when funds are invested in a capitalisation or life insurance contract, it is crucial that the agreement (convention) for the repartition of rights respects the rights and duties of both the bare owner and the usufructuary. This ensures that the specific advantages of life insurance and capitalisation contracts, as well as the mechanism of repartition of rights, are fully utilised.

Key Points to Remember:

Footnotes:

This case study examines the inheritance planning and wealth management strategy for a middle-aged couple in Belgium. With a €4 million investment, they aim to structure their wealth efficiently, retain control over their assets, provide for their three children, and implement a unified family investment strategy. The tailored solution and its benefits are outlined below.

For expatriates planning to return to France, strategic gifting can play a crucial role in minimising tax liabilities.

This case study explores the options available to a French expatriate family residing in Dubai. As they plan to return to France, the couple aims to efficiently transfer €8 million to their children while minimising tax liabilities

Learn how a client used an insurance-based wealth solution with built-in restrictions to efficiently manage UK inheritance tax planning, ensuring wealth is passed on to future generations while maintaining control over access.

Explore how a senior executive effectively manages his wealth and ensures seamless transfer to his heirs using Singapore beneficiary nominations and an insurance solution.

This case study highlights the flexibility, control and asset protection offered by these financial planning strategies.

This case study explores how an insurance-based wealth solution can be used in Spain to facilitate gifting with control to the next generation in a tax-efficient manner.

By examining the specific case of a 70-year-old widow in Madrid, we highlight the benefits and strategic advantages of using these insurance solutions for wealth transfer and succession planning.

María is a 70-year-old Spanish tax resident widow who lives in Madrid. She holds a €5 million financial portfolio as a result of the sale of her company some years ago.

She has two adult daughters who are currently resident in the UK and France, but they may return to Spain in the future or move elsewhere.

María is concerned about the potential impact of Spanish inheritance tax on her daughters, especially if there are future changes to the Spanish Inheritance and Gift Tax rules.

Some years ago, she already gifted certain assets to her daughters, taking advantage of the favourable gift tax rules in Madrid, but she is not willing to gift more assets at this stage.

María’s advisers recommend that she subscribes to two mixed-term unit-linked life insurance policies with a foreign specialised insurer, covering both the survival and death contingencies. The contracts shall be governed by Spanish law and will be issued and executed in either Ireland or Luxembourg.

The proposed policy structure, for each contract, will be as follows:

A recommendation is made to include certain special conditions in these policies by which, in case of María’s death (as policyholder), the policy’s survival benefit shall only be paid to her daughters 3 and 7 years respectively after her date of death. In case of the death of all lives assured, the death benefit shall be paid to María’s grandchildren. It would also be possible to include certain special conditions to prevent them from receiving the death benefit in they are too young at that time, or to receive it in different instalments.

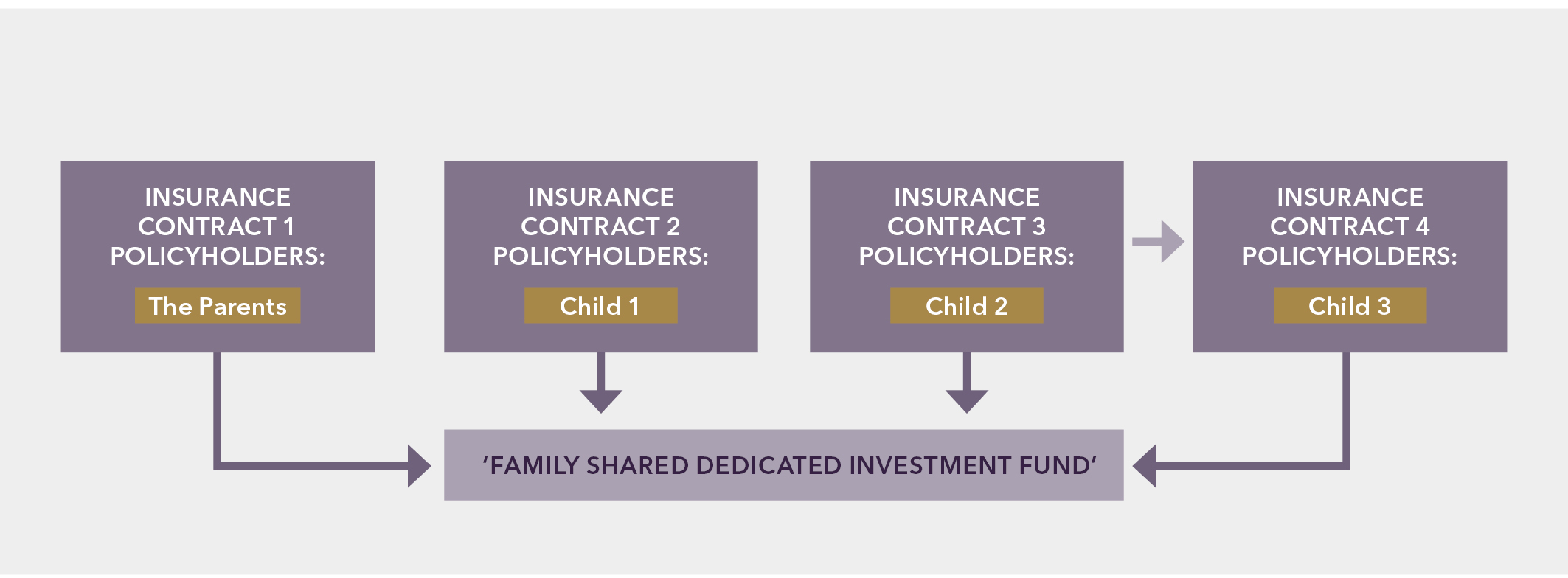

Mr and Mrs Janssens are a middle-aged couple living in Belgium. They have three children, who also reside in Belgium. The couple want to invest approximately €4 million into a discretionary managed investment portfolio. They want this investment to be linked to their inheritance planning.

Client Requirements

Subscription of Four Insurance Contracts

The Janssens subscribe to four insurance contracts, each underpinned by a ‘Family Shared Dedicated Investment Fund’ that encompasses the entire family's assets.

Step-by-Step Process

Step 1: Subscription and Gift

Step 2: Insurance Contracts for Children

Step 3: Creation of the Fund

A French couple, aged 52 and 49, along with their two children, aged 18 and 16, have lived in Dubai for the past 12 years. As they plan to return to France, they aim to efficiently transfer their wealth to their children. The couple has earmarked a total of €8 million to be gifted equally to their children, with each parent contributing €2 million per child.

Key Tax Consideration: While Dubai does not impose gift taxes, France applies high progressive rates to gifts, which could result in significant liabilities if the family were to gift assets after repatriation.

To address their concerns, the couple has two options:

Option 1: Gifting While Residing in Dubai

While living in Dubai, the couple can gift their “non-French” assets to their children without incurring French gift tax. Each parent gifts €2 million to each child, totalling €4 million per child. The children can then reinvest the gifted amount into life insurance policies, benefiting from long-term tax efficiency.

Option 2: Gifting After Returning to France

As the family prepares to return to France, they face the challenge of transferring their wealth without incurring substantial gift taxes. In France, gift tax is calculated for each recipient based on what they receive from each donor, with a progressive rate applied after an allowance of €100,000 per parent per child.

The couple plans to gift €4 million to each child (€2 million from each parent). After applying the €100,000 allowance per parent, the taxable amount per child becomes €1.9 million from each parent. Since each child receives €2 million from each parent, the total taxable base is €3.8 million per child.

The French gift tax follows progressive rates, resulting in the following potential liability:

By waiting to return to France before making the donation, the family would owe over €2.4 million in gift taxes. This underscores the importance of strategic planning and the substantial tax savings that can be achieved by gifting while still residing in Dubai.

This case study illustrates the substantial tax savings of planning gifting strategies prior to repatriation. The benefits of using a life insurance solution include:

Important: The solution in this case study is exclusively available through policies issued by Utmost Wealth Solutions’ Luxembourg carrier, Lombard International Assurance SA (now part of Utmost Group), for policy premiums exceeding £1 million.

Mr Smith is a retired grandfather who wants to start his UK inheritance tax planning and skip a generation of inheritance taxation by passing on his wealth equally to his four grandchildren. He has £4 million to gift but is concerned about giving access to such a large sum of money too early.

Mr Smith subscribes to four international bonds with Utmost Wealth Solutions’ Luxembourg carrier, Lombard International Assurance SA (now part of Utmost Group).

To meet Mr Smith’s objective of limiting access while gifting effectively, conditions are written into the contract which:

The suppression period and annual withdrawals can be tailored on each contract to the age and needs of each grandchild that the international bond is to benefit.

Mr Smith can subsequently gift the international bonds to individuals if over the age of 18, or to a bare trust for minor grandchildren.

This gift is treated as a potentially exempt transfer for UK inheritance tax purposes, and Mr Smith has control over the age at which the grandchild has access to the capital. The international bond grows free of income and capital gains taxation (save for any non-reclaimable withholding taxes). In addition, the gift of the international bond into trust or to an individual is not a chargeable event for UK income tax purposes.

This solution is ideal for those who have surplus wealth to make outright gifts for inheritance tax planning, without the recipient receiving access at a young age.

Mr Leung is a senior executive at a Blue-Chip Technology Company and has successfully invested in private equity opportunities over the years. He is married with one child. His financial planning concerns include maintaining control over his investments, ensuring seamless wealth transfer to his heirs and maintaining flexibility to adapt to future changes in his financial priorities.

As his family grows, he wants to ensure that his wealth is distributed fairly and securely among his wife and children, while also considering the potential impact of future business ventures on his personal wealth.

To address his concerns, Mr Leung initially sets up a Singapore investment-linked insurance policy, and nominates his wife and first child as beneficiaries on a revocable basis. This arrangement allows him to:

As his family grows, Mr. Leung amends the nomination to include his additional two children as beneficiaries.

Some years later, Mr Leung enters into a new business venture, which requires him to secure a substantial recourse loan. Mr Leung worries that, should this venture fail, his insurance policy and other personal wealth could be at risk from his creditors. To protect his policy from this, he revokes the nomination and instead makes an irrevocable nomination in favour of his three children and appoints a trusted family member to act as Trustee with him.

The advantage of this arrangement is that:

Eventually, Mr Leung’s business venture succeeds, and he becomes debt-free. For this reason, he feels that it is no longer necessary to retain the irrevocable nomination, and he would like to have full control over the insurance policy. In addition, he worries about his children’s ability to handle unconstrained access to a substantial legacy should the policy death benefits pay directly to them.

He discusses this with his co-trustee, and they agree that it is in the family’s interest to revoke the nomination. The trustee can agree to this without recourse to the beneficiaries. The revocation reinstates Mr Leung’s sole control of, and access to, the policy.

To address concerns about his children's ability to manage a substantial legacy, he creates a separate discretionary trust and nominates the trust as the beneficiary of the policy. This "pilot trust" structure allows for controlled distribution of the death benefits.

This solution provided several benefits for Mr. Leung:

Market

Event

Date

UK

Concerned about the increase in CGT rates?

Join Steve Sayer, Technical Sales Manager, to learn how wrapped investments can mitigate capital gains tax, ease administration and offer flexibility. Hosted by Marc Acheson, Global Wealth Specialist with case studies and an interactive Q&A session featuring Simon Martin, Head of UK Technical Services.

23 April | 9.30 AM BST Register now

LatAm

International Private Client Conference Miami 2025

A premier event for multigenerational businesses, exploring global strategies in governance and wealth planning with top industry leaders.

24 April 2025 | 8.30 AM – 7.30 PM EDT Find out more

France

Sommet Patrimoine et performance

The summit will provide an opportunity for industry professionals to gather and reflect on current issues and best practices, while providing public recognition for the initiatives and innovations of passionate leaders and entrepreneurs.

09 July 2025 Find out more

To contact the team, simply get in touch via the Ask Us Anything form below.

Day to day technical support

Inheritance tax and wealth transfer planning

Online technical portal

Trust analysis service

European portability review service

The latest regulatory and tax developments

Product structuring to address specific client needs

The information presented in this briefing does not constitute tax or legal advice and is based on our understanding of legislation and taxation as of January 2025. This item has been prepared for informational purposes only. Utmost group companies cannot be held responsible for any possible loss resulting from reliance on this information.

This briefing has been issued by Utmost Wealth Solutions. Utmost Wealth Solutions is a business name used by a number of Utmost companies:

Utmost International Isle of Man Limited (No. 024916C) is authorised and regulated by the Isle of Man Financial Services Authority. Its registered office is King Edward Bay House, King Edward Road, Onchan, Isle of Man, IM99 1NU, British Isles.

Utmost PanEurope dac (No. 311420) is regulated by the Central Bank of Ireland. Its registered office is Navan Business Park, Athlumney, Navan, Co. Meath, C15 CCW8, Ireland.

Utmost Worldwide Limited (No. 27151) is incorporated and regulated in Guernsey as a Licensed Insurer by the Guernsey Financial Services Commission under the Insurance Business (Bailiwick of Guernsey) Law, 2002 (as amended). Its registered office is Utmost House, Hirzel Street, St Peter Port, Guernsey, GY1 4PA, Channel Islands.

Lombard International Assurance S.A. is registered at 4, rue Lou Hemmer, L-1748 Luxembourg, Grand Duchy of Luxembourg, telephone +352 34 61 91-1. Lombard International Assurance is regulated by the Commissariat aux Assurances, the Luxembourg insurance regulator.

Where this material has been distributed by Utmost International Middle East Limited, it has been distributed to Market Counterparties on behalf of Utmost Worldwide Limited by Utmost International Middle East Limited. Utmost International Middle East Limited is a wholly owned subsidiary of Utmost Worldwide Limited and is incorporated in the Dubai International Financial Centre (DIFC) under number 3249, registered office address Office 14-36, Level 14, Central Park Towers, Dubai International Financial Centre, PO Box 482062, Dubai, United Arab Emirates and is a company regulated by the Dubai Financial Services Authority (DFSA).

Further information about the Utmost International regulated entities can be found on our website at https://utmostinternational.com/regulatory-information/ .

© 2026 Utmost Group plc