This briefing is designed for financial advisers only and should not be distributed to or relied upon by individual investors.

This briefing is designed for financial advisers only and should not be distributed to or relied upon by individual investors.

Welcome to the inaugural edition of Utmost Navigator, our brand-new quarterly technical briefing! At Utmost Wealth Solutions, our technical team boasts extensive expertise in tax, legal, and regulatory matters. We are dedicated to providing practical and timely support to our partners, and with Utmost Navigator, we aim to elevate our technical offerings even further.

Each edition of Utmost Navigator will keep you updated with the latest developments in tax, regulatory, and legal landscapes within our core life assurance markets. You’ll also discover the latest enhancements in our products and services, all designed to support your evolving needs. Get to know our Technical Services Team better and see how we can assist you.

One of the key themes that we explore in our first edition is portability. Our clients lead sophisticated, mobile lives, and as their personal circumstances change, so do their financial planning needs. Life insurance remains a straightforward and widely recognised financial structure across Europe and beyond. Our portability solutions are crafted to be a crucial part of planning for your clients’ financial futures.

Don’t miss out on Pulse – our innovative tool that highlights upcoming regulatory, tax and compliance changes. Whether at the UK, EU, international or local level, Pulse will keep you informed and prepared. We will ensure this tool is updated with every edition to provide you with the most current information.

We are also thrilled to feature an exclusive interview with José Luis López-Hermida of KPMG Spain. In conversation with Nerea Llona, our Tax and Legal Counsel for Spain and LatAm, José shares insights on the latest trends in wealth migration and taxation. He also delves into the benefits and flexibility of unit-linked life insurance in wealth and succession planning.

We hope you find our first edition both informative and inspiring.

Aidan Golden

Under Irish rules, UK Trustees holding an Irish life policy must register on the Irish Central Register of Beneficial Ownerships of Trusts (CRBOT).

The original registration process was unfit for UK Trustees, as it assumed they would access the CRBOT through the Revenue’s Online Service (ROS). This proved cumbersome, leading to the suspension of the registration process for UK Trustees while an alternative solution was sought. However, this suspension did not remove the requirement for Irish life companies to check for discrepancies between the information provided by Trustees and the register.

The original registration process was unfit for UK Trustees, as it assumed they would access the CRBOT through the Revenue’s Online Service (ROS). This proved cumbersome, leading to the suspension of the registration process for UK Trustees while an alternative solution was sought. However, this suspension did not remove the requirement for Irish life companies to check for discrepancies between the information provided by Trustees and the register.

Several members of the Utmost Technical Services team, as active participants in insurance industry bodies, have been directly involved in discussions with the Irish Revenue and the CRBOT to resolve the registration issues for both UK Trustees and life companies.

It is anticipated that by the end of this year, UK and other non-EU trustees with Irish policies will be able to register on the CRBOT by completing a downloadable spreadsheet from the CRBOT website. Comprehensive guidance on how to register will also be provided. Once submitted, UK Trustees will receive a reference number in a letter, instructing them to contact their life policy provider for discrepancy checks against the register.

While the availability of the registration process is welcomed, several issues remain:

Utmost Technical Services team will continue to collaborate with the industry and the Irish Revenue to address these issues.

As the only company among its peer group with a footprint in Europe, Asia, and the Middle East, Utmost Wealth Solutions is uniquely positioned to offer compliant solutions to High-Net-Worth (HNW) individuals and families with multi-jurisdictional profiles that span continents.

We often encounter individuals who have purchased a Private Placement Life Insurance (PPLI) solution in Asia or the Middle East and plan to relocate elsewhere in the future. While a local solution may work well while the policyholder resides in Asia or the Middle East, or if they repatriate to certain jurisdictions (e.g., the UK or Australia), they may need a different solution if they relocate to a European Union country.

A non-EU PPLI may not meet the regulatory and tax qualification requirements of the target EU destination. This can lead to issues with recognition, denial of tax advantages, and conflicts of law that may complicate estate planning.

This is where our portability solutions have been extremely valuable to customers moving around Europe, complemented by our ability to offer EU-compliant solutions via advisers authorised in the Dubai International Financial Centre (DIFC).

For our Asia and Middle East-based clients, we have enhanced this valuable service by introducing our “Continuity Service”.

The Utmost Continuity Service is available to High-Net-Worth individuals who already hold a policy valued at US$1 million or more, issued by Utmost Wealth Solutions in one of our regulated markets. If the policyholder decides to relocate to an EU country where Utmost offers a compliant solution, we can offer a substitution service if it results in a more favourable client outcome.

The ability to offer our Continuity Service means that our clients continue to benefit from Utmost’s wealth planning solutions, with the assurance that their contract is designed specifically to provide tax and estate planning advantages in their new country of residence. Additional benefits may include seamless transfer of investments and a rebasing of capital for tax purposes.

For more information, we have produced a detailed guide, which is available from your Utmost Wealth Solutions sales representative.

Imagine a high-net-worth family that has worked tirelessly to accumulate their wealth, with family members contemplating a move to Australia. They aim to pass this wealth to the next generation, who will become Australian residents. How can they ensure this transition is both smooth and tax-efficient? One intriguing solution lies in leveraging life insurance solutions.

Life insurance solutions from Utmost offer a portable and flexible means to manage wealth across borders. By utilising a life insurance solution, the family can maintain control over their assets while benefiting from tax efficiency in Australia. Utmost insurance products are “eligible policies” for Australian tax purposes, which means they can provide significant tax benefits when structured correctly.

We regularly review our contracts to ensure they are tax compliant for policyholders considering relocating to Australia, and we have sought formal product tax rulings to confirm our understanding.

Tax benefits include tax-deferred internal investment growth, meaning the family won’t face immediate tax liabilities on underlying investment income and gains. This deferral can be particularly advantageous for families looking to accumulate wealth before passing it on to the next generation. Additionally, the policy can be designed to ensure that the proceeds are distributed in a tax-efficient manner, minimising the tax burden on the beneficiaries.

But here’s where it gets even more interesting: the flexibility of these policies accommodates estate planning tailored to the family’s unique circumstances, either through simple beneficiary nominations, or in conjunction with a family trust to control the timing of distributions.

Curious about how this could work for your clients and their family? The nuances of life insurance and its tax implications can be complex, but that’s where expert technical support comes in.

For more details on how you can make the most of these opportunities for your clients, contact your Utmost Wealth Solutions sales representative. After all, the right strategy today could mean a world of difference tomorrow. Let’s dive into the details together!

In an interview with Nerea Llona, Tax and Legal Counsel - Spain and LatAm, José Luis López-Hermida of KPMG Spain discusses the use of unit-linked life insurance as an alternative to Anglo-Saxon trusts for high-net-worth individuals in Spain. This article explores the benefits and flexibility of unit-linked life insurance in wealth and succession planning.

Recent data indicates that over 128,000 high-net-worth individuals will relocate in 2024, driven by significant tax changes in traditionally attractive countries like the UK, Italy, and Portugal. Spain, with its favourable tax regimes such as the ‘Beckham Law’ and new incentives in Madrid for those who are resident there, is becoming a preferred destination, especially for Latin Americans.

Traditional planning vehicles like private holding companies, private foundations, and trusts face certain operational, legal, and tax challenges in Spain. Trusts, in particular, are not recognised in Spanish law and are transparent for tax purposes, complicating their use for estate planning and prompting the need for alternative solutions.

Unit-linked life insurance offers several benefits:

This type of insurance allows policyholders to establish terms and conditions for the policy offering flexibility in estate and succession planning. It enables the transfer of assets to be deferred and divided according to the policyholder’s instructions, regardless of the provisions of the last will and testament. Beneficiaries and conditions can usually be modified as needed, and payments of the insurance benefit can be planned in advance independently of unpredictable events like death.

Unit-linked life insurance is similar to trusts in involving professional managers and custodians to hold assets, whilst it provides the necessary legal security and is fully regulated under Spanish law. Specialised insurers based in Luxembourg and Ireland are noted for their expertise in this area, offering significant advantages in investor protection and potential VAT savings to the policyholder.

Unit-linked life insurance is a robust alternative to trusts, providing flexibility and legal security from a Spanish perspective in an unstable regulatory and tax environment. It helps high-net-worth individuals navigate the complexities of international wealth taxation effectively.

Our Senior Wealth Planner for France, Benjamin Fiorino, shares insights into our cutting-edge expertise on the complex topic of dismemberment.

In France, a capitalisation policy is almost systematically used for the reinvestment of dismembered capital. However, since the most recent Court of Cassation case law in October 2023, single life insurance policies have often become a better solution for optimising and planning your client’s estate.

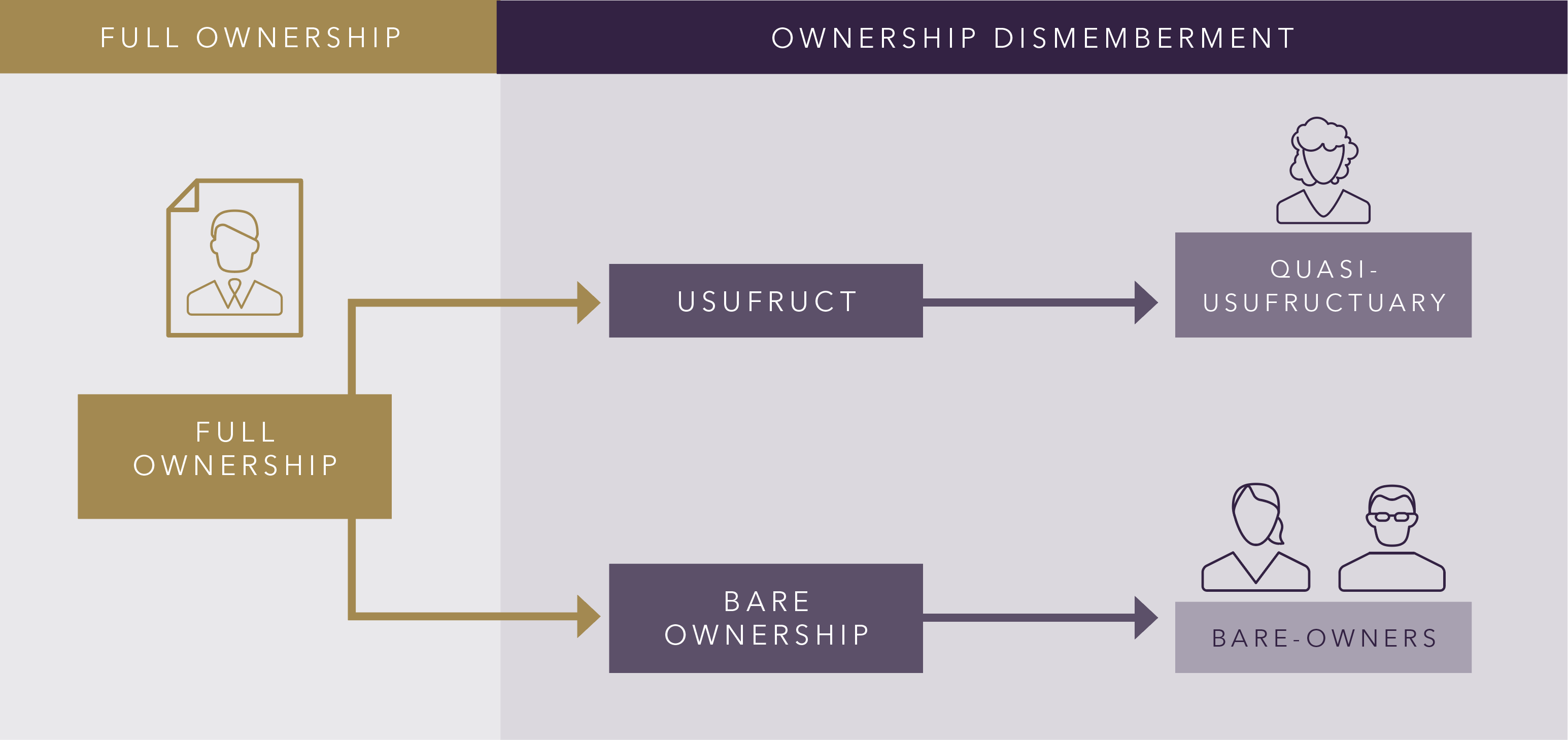

A dismembered beneficiary clause enables insurance death benefits to be efficiently passed to the insured’s heirs. It often designates the spouse as the “usufructuary” (the person who will have access to the capital during their lifetime) and the children as “bare owners” (the recipients of the capital upon the death of the usufructuary).

Upon the policyholder’s death, the death benefit[1] is paid in full to the usufructuary spouse, while the children, as bare owners, have a right to claim on the surviving spouse’s estate.

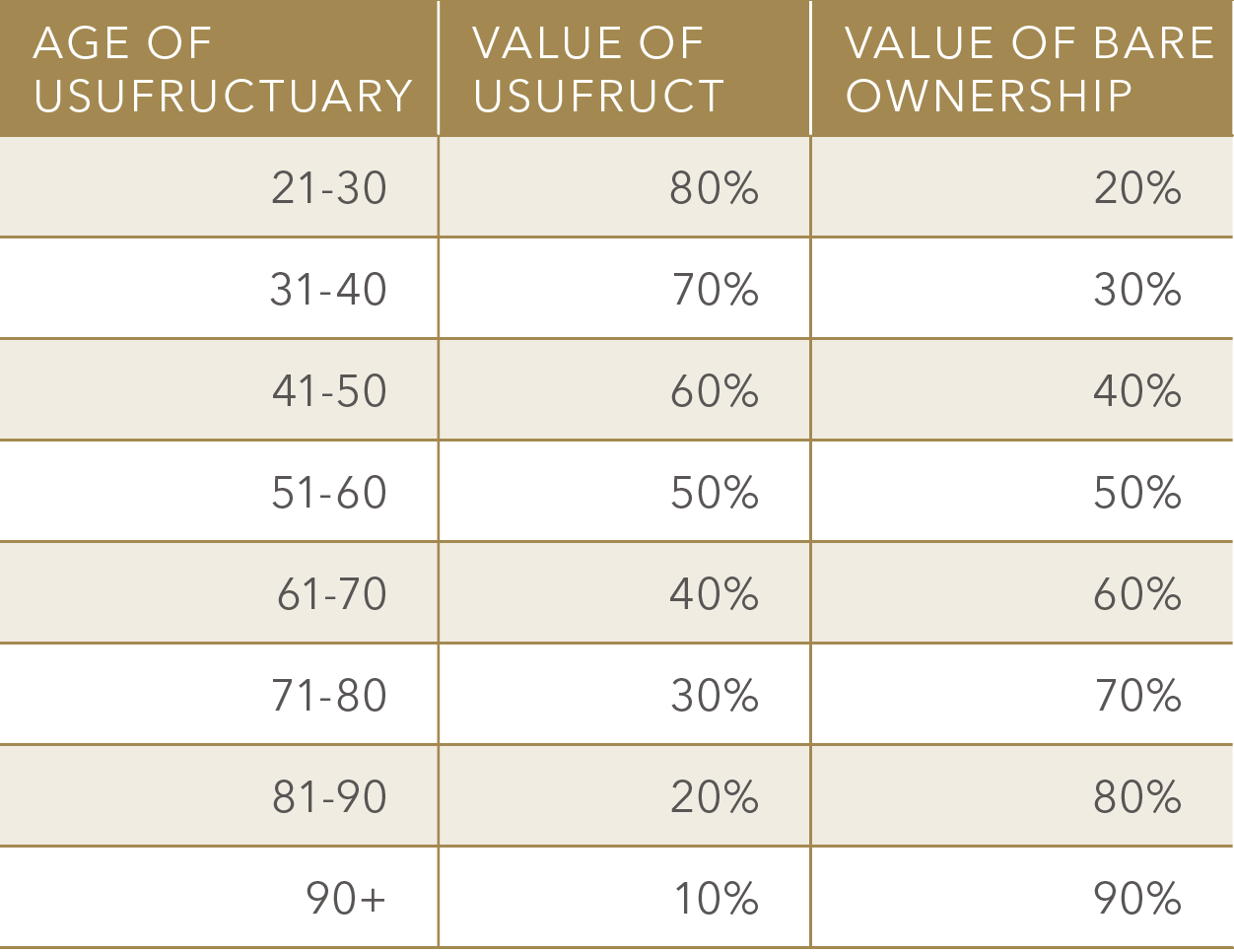

The advantage of this arrangement is that the children, as bare owners, are only taxed on a portion of the death benefit depending on the age of the usufructuary spouse (see table below). Meanwhile, their restitution claim is on 100% of the death benefit. The usufructuary spouse is exempt from inheritance taxation.

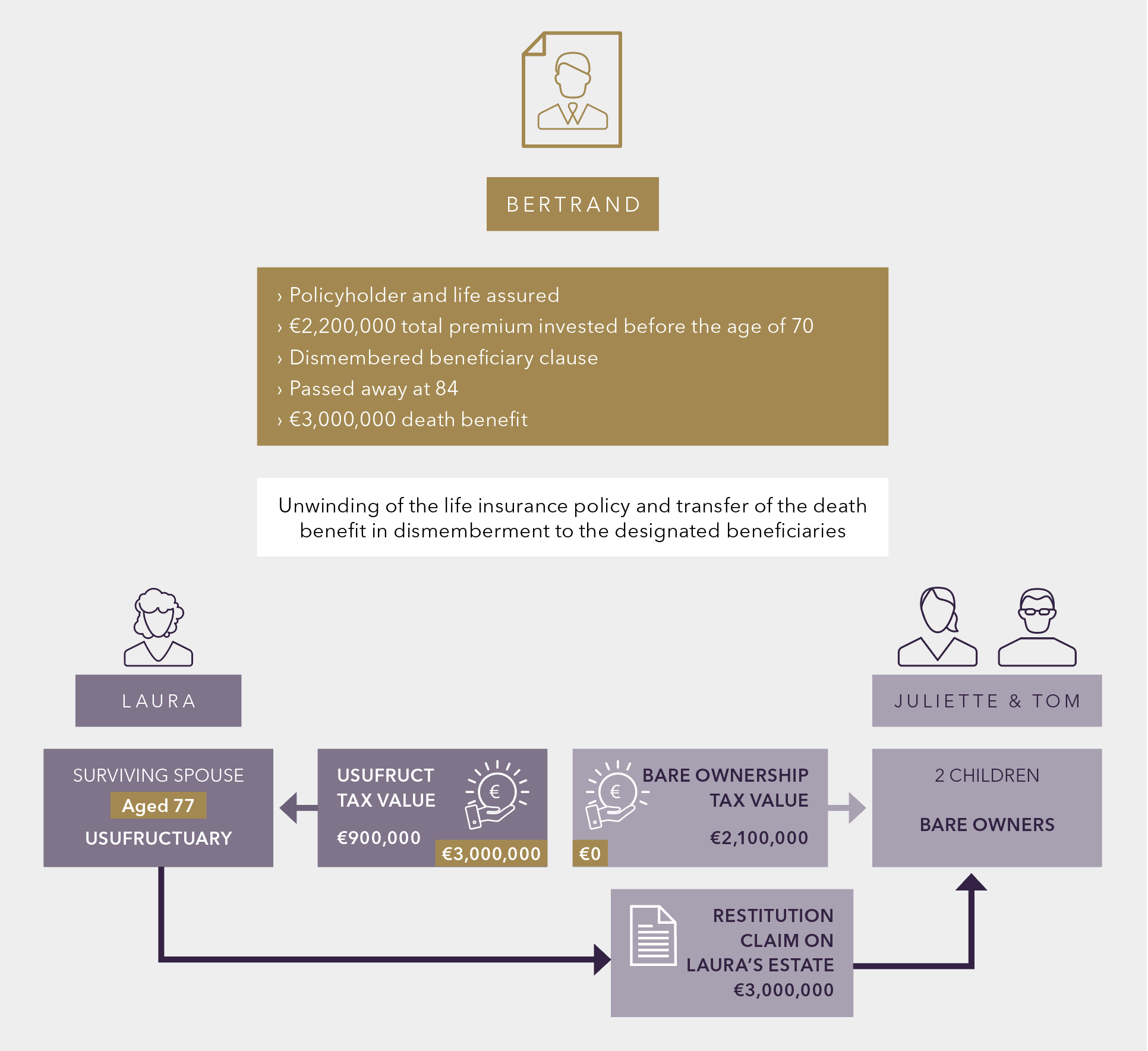

At 68, Bertrand takes out a life insurance policy for €2,200,000 with the dual objective of protecting his wife, Laura, and ultimately passing his wealth efficiently to his children, Tom and Juliette. Consequently, he chooses a dismembered beneficiary clause.

Upon Bertrand’s death, Laura receives €3,000,000, and the children each have a claim of €1,500,000 on her estate while only paying taxation of €943,250 each (€216,015 tax per beneficiary).

Laura may decide to reinvest the €3,000,000 dismembered capital into a capitalisation policy or a life insurance policy, such as Private Wealth Portfolio France.

The recent Court of Cassation case law (11 October 2023) confirms that when reinvesting the €3,000,000 dismembered capital in a life insurance policy with the bare-owner children designated as ‘free of charge’ beneficiaries (à titre gratuit), upon Laura’s death, the children will be taxed on the death capital they receive under the favourable life insurance conditions. Additionally, they will benefit from the restitution claim of €3,000,000 received upon Bertrand’s death on the remaining estate of Laura.

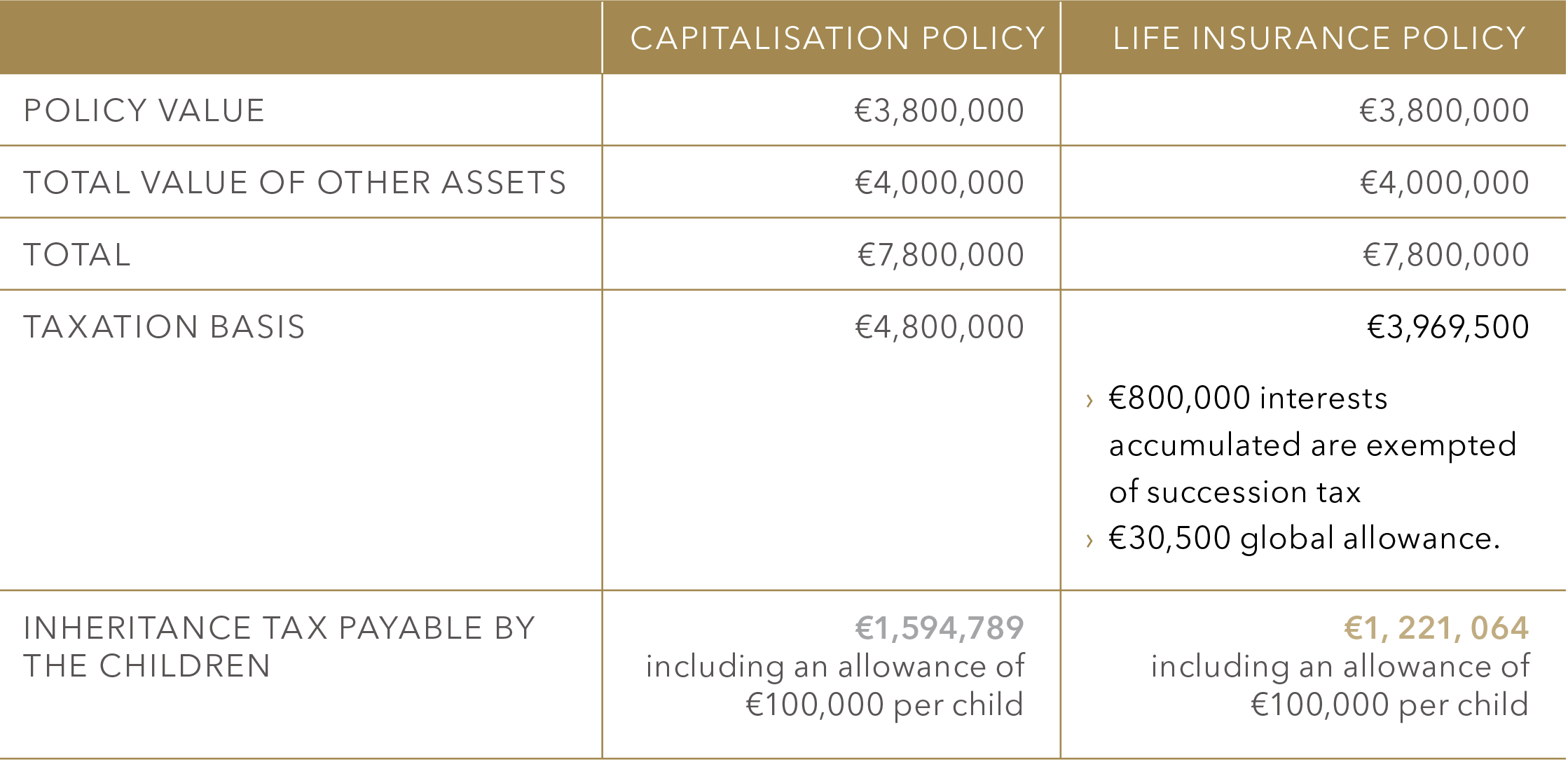

The table below compares the taxation due by the children depending on whether Laura reinvests the €3,000,000 dismembered capital into a life insurance policy or a capitalisation policy.

Assuming that upon her death the dismembered capital is worth €3,800,000 and her real estate is valued at €4,000,000.

With a tax saving of over €373,000, a life insurance policy, such as Private Wealth Portfolio France, is significantly more tax-efficient compared to a capitalisation policy.

Marie Salvo, Head of Sales for France, and Benjamin Fiorino have developed a detailed guide, addressing several scenarios and practicalities with major impacts.

This guide is exclusively reserved for our partners.

To receive this comprehensive resource packed with invaluable insights and detailed scenarios, contact Marie Salvo.

Marie Salvo

Head of Sales – France and Monaco

E: [email protected]

M: +33 (0)6 29 47 66 92

Jim, a 60-year-old UK tax resident, is planning to retire in Spain at age 65. With a lump sum of €2,000,000 to invest, Jim seeks a tax-efficient solution that remains compliant in both the UK and Spain.

This case study explores how a tailored offshore bond can provide the flexibility and tax advantages needed for a smooth transition to retirement abroad.

Jim, a 60-year-old UK tax resident, is still working but plans to retire in Spain at age 65, where he already owns a property. He has a lump sum of €2,000,000 to invest now and is keen to do so in a tax-efficient manner. Jim wants to ensure that he does not have to restructure his investment when he moves to Spain in five years’ time.

Investing in a financial product that is tax efficient in both the UK and Spain can be challenging due to differing tax regimes. Additionally, many offshore bond providers lack the capability to offer portability when moving out of the UK. Furthermore, some providers are not fully aware of the complexities involved in ensuring the offshore bond remains compliant in Spain. Key aspects of a policy that may need to be amended include:

An offshore bond from Utmost Wealth Solutions offers Jim a compliant and tax-efficient solution in both jurisdictions. Our Technical Services team possesses the tax and regulatory expertise to adapt the policy and make it portable from its inception, ensuring it remains compliant and tax-efficient in both the UK and Spain.

Jim will benefit from the following tax advantages:

For more details about our Spanish portability offering, contact your Utmost Wealth Solutions sales representative.

Market

Event

Date

Italy (Milan)

Annual Associazione Italiana Private Banking (AIPB) Private Banking Forum 2024

21 November Find out more

Day to day technical support

Inheritance tax and wealth transfer planning

Online technical portal

Trust analysis service

European portability review service

The latest regulatory and tax developments

Product structuring to address specific client needs

The information presented in this briefing does not constitute tax or legal advice and is based on our understanding of legislation and taxation as of October 2024. This item has been prepared for informational purposes only. Utmost group companies cannot be held responsible for any possible loss resulting from reliance on this information.

This briefing has been issued by Utmost Wealth Solutions. Utmost Wealth Solutions is a business name used by a number of Utmost companies:

Utmost International Isle of Man Limited (No. 024916C) is authorised and regulated by the Isle of Man Financial Services Authority. Its registered office is King Edward Bay House, King Edward Road, Onchan, Isle of Man, IM99 1NU, British Isles.

Utmost PanEurope dac (No. 311420) is regulated by the Central Bank of Ireland. Its registered office is Navan Business Park, Athlumney, Navan, Co. Meath, C15 CCW8, Ireland.

Utmost Worldwide Limited (No. 27151) is incorporated and regulated in Guernsey as a Licensed Insurer by the Guernsey Financial Services Commission under the Insurance Business (Bailiwick of Guernsey) Law, 2002 (as amended). Its registered office is Utmost House, Hirzel Street, St Peter Port, Guernsey, GY1 4PA, Channel Islands.

Where this material has been distributed by Utmost International Middle East Limited, it has been distributed to Market Counterparties on behalf of Utmost Worldwide Limited by Utmost International Middle East Limited. Utmost International Middle East Limited is a wholly owned subsidiary of Utmost Worldwide Limited and is incorporated in the Dubai International Financial Centre (DIFC) under number 3249, registered office address Office 14-36, Level 14, Central Park Towers, Dubai International Financial Centre, PO Box 482062, Dubai, United Arab Emirates and is a company regulated by the Dubai Financial Services Authority (DFSA).

Further information about the Utmost International regulated entities can be found on our website at https://utmostinternational.com/regulatory-information/ .

© 2026 Utmost Group plc